With Donald Trump’s inauguration less than a week away, questions loom about the future of solar energy in America. Will the progress made in renewable energy over the past two decades continue, or will new policies hinder the solar industry’s growth?

Thanks to federal incentives, state initiatives, and the declining costs of technology and installation, the solar industry has seen a steady annual growth of 24% since 2000. Over this time, policies and incentives have changed, but the industry has remained resilient, with solar becoming more affordable and accessible with each passing year.

Since the passage of the Inflation Reduction Act in 2022, solar has become the nation’s leading source of new energy installations. However, with a shift in leadership, many are wondering what will happen to the industry. Will solar continue its upward trajectory under Trump’s second term?

Trump’s first term focused heavily on energy independence, but much of the emphasis was on oil, coal, and natural gas, with renewables often taking a backseat through budget cuts, tax incentives reductions, and regulatory rollbacks.

His second term will likely bring new challenges for the solar industry, from potential trade restrictions on imported solar panels to weakened federal incentives. However, it will also spark opportunities as the industry adapts to these restricted incentives and, as always, innovates despite them.

Since the election, many people have asked us what we expect under the new administration. We’ve conducted a thorough investigation into Trump’s first term and consulted with top policy experts to gain a clear understanding of what his second term could mean for the future of solar.

The solar industry has always been resilient, and it’s proven time and time again that it can innovate and grow despite anti-renewable lobbying and shifting policies. In this article, we’ll take a closer look at the past, present, and future of solar energy, exploring what happened under Trump’s first term, what’s likely to happen next, and what you can do to help the solar industry continue to grow for the next four years.

Table of Contents

- A Look Back at President Trump’s First-Term Energy Policies

- Trump’s Solar Energy Comments on the Campaign Trail

- President Trump’s Appointments and Their Implications for Solar

- Republican Lawmakers and Solar Policy

- Federal Incentives and the IRA

- State Policies and Incentives

- Challenges Facing the Solar Industry for the Next Four Years

- What’s Next for Solar

- What Can Solar Advocates Do?

A Look Back at President Trump’s First-Term Energy Policies

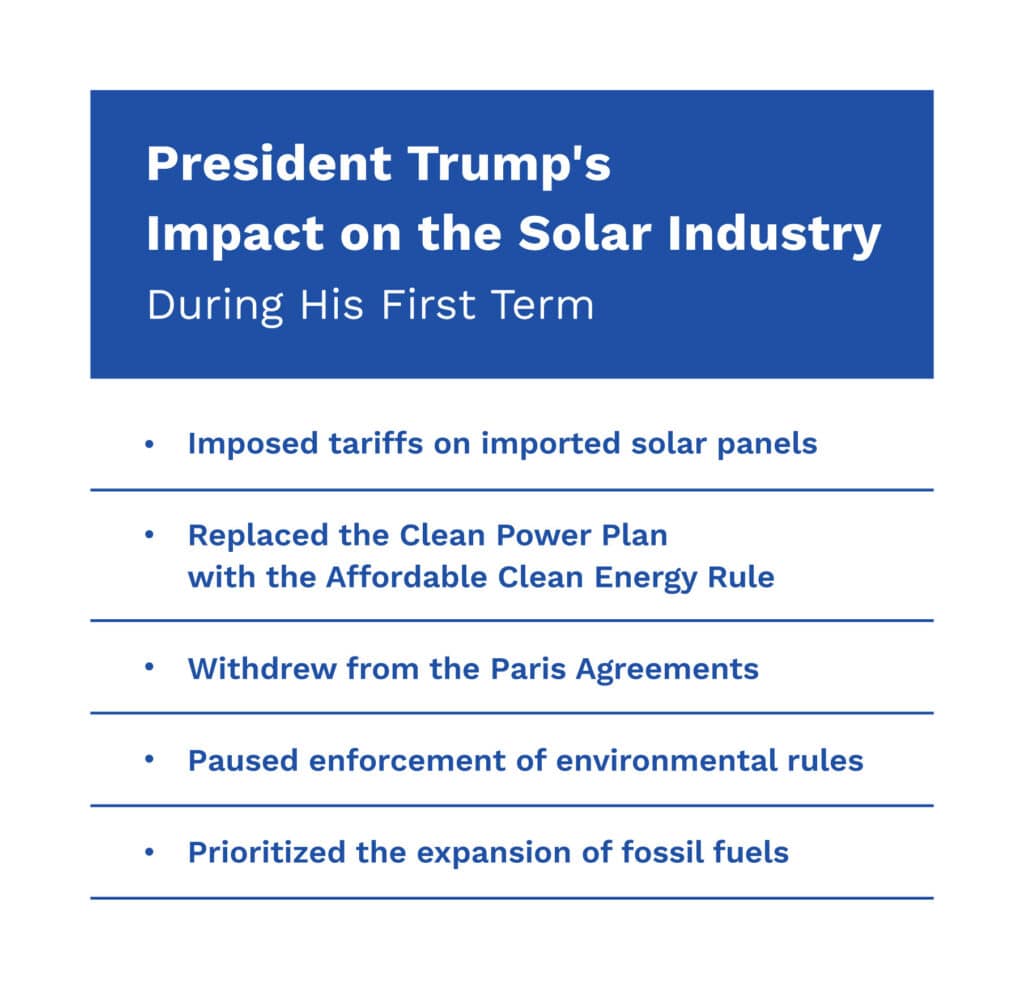

Donald Trump’s first term as President significantly changed energy policies in the United States. His administration focused on supporting fossil fuels while scaling back environmental protections and renewable energy regulations.

Throughout his first term, the President-elect’s administration enacted several policies that shaped the American energy landscape. Below are the actions that most directly impacted the U.S. solar market:

- Rolled back the Clean Power Plan and replaced it with the Affordable Clean Energy Rule, which had fewer requirements for reducing emissions

- Withdrew from the Paris Agreement on June 1, 2017, choosing not to participate in global commitments to reduce greenhouse gas (GHG) emissions

- Temporarily paused enforcement of some environmental rules during the COVID-19 pandemic.

- Promoted the idea of American “energy dominance” to expand the production of fossil fuels, removing oil and gas drilling restrictions and opening certain public lands and waters for exploration.

- Imposed tariffs on imported solar panels, helping some U.S. solar manufacturers gain market share but making many solar projects more expensive in the process.

President Trump’s First-Term Impact on the Solar Industry

Imposing tariffs on imported solar panels led to increased prices for solar projects and components. As a result, homeowners and small businesses found it more expensive to install solar energy systems, which slowed the growth of domestic solar. Tariffs imposed on imported solar cells and modules by Trump’s first administration eliminated more than 62,000 jobs, deterred $19 billion in private investment, and thwarted 10.5 gigawatts of planned solar installations.

Tariffs made imported panels more costly, encouraging some American companies to start or expand their solar panel production within the country. While American solar manufacturing grew, the higher costs for consumers slowed the solar industry’s growth, especially among homeowners and small businesses.

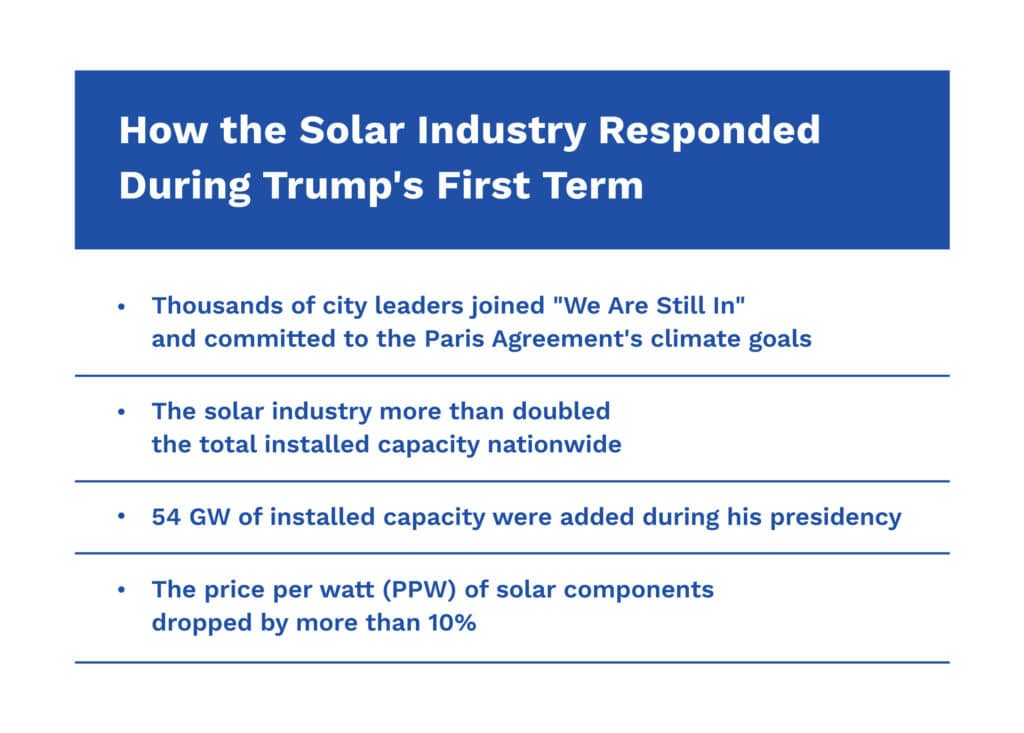

The U.S. withdrawal from the Paris Agreement under the Trump administration diminished U.S. influence and participation in international climate negotiations until President Biden re-joined in 2021. Domestic renewable investment and emissions reduction efforts were still boosted nationwide by grassroots climate actions like We Are Still In, which partially compensated for federal inaction but could not fully replace a cohesive national climate strategy.

Despite these headwinds, the U.S. solar industry nearly doubled its installed capacity—from 36 to 40 GW at the end of 2016 to more than 100 GW by 2020.

Nearly 54 GW of new solar capacity was added during his presidency (including a record 19.2 GW in 2020), pushing solar’s share of the nation’s electricity generation from roughly 1–1.5% in 2016 to over 3% by 2020. Although solar employment dipped from 260,000 jobs in 2016 down to roughly 231,000 to 250,000 by 2020, the cost-competitiveness of solar technology continued to improve, and federal incentives like the Investment Tax Credit (ITC) and robust state-level mandates helped sustain growth.

Despite all odds, solar component costs dropped more than 10% during Trump’s presidency.

As President-elect Trump takes office for his second term, the industry is in a very different place than it was four years ago. There is over 220 GW of installed solar and storage capacity nationwide, and over 100 domestic solar and storage manufacturing plants are located in 43 states. The components are cheaper than ever.

Trump’s Solar Energy Comments on the Campaign Trail

During his 2024 presidential campaign, Trump repeatedly emphasized his belief that renewable energy sources are expensive and unreliable. He argued that these technologies cannot consistently meet the nation’s energy needs and should be secondary to traditional energy sources like coal, oil, and natural gas.

Though the former President was far more openly critical of wind power than he was of solar, he mentioned solar power specifically a few times on the campaign trail:

“[If Harris is elected] Oil will be dead. Fossil fuel will be dead. We’ll go back to windmills and we’ll go back to solar, where they need a whole desert to get some energy to come out. You ever see a solar plant? By the way, I’m a big fan of solar. But they take 400, 500 acres of desert soil.”

– President-elect Donald Trump during a debate with Vice President Kamala Harris

“I saw a solar field the other day that looked like it took up half the desert. It’s all steel and glass and wires and looks like hell. And you see rabbits, they get caught in it, for the environmentalists. It’s just terrible.”

– President-elect Donald Trump during a campaign event in October 2024

A cornerstone of Trump’s campaign was his opposition to the Inflation Reduction Act (IRA), which he pledged to repeal. Referring to the IRA as the “greatest scam in history” and the “green new scam,” Trump criticized its tax credits and incentives for renewables as wasteful government spending.

Throughout his campaign, Trump also reinforced his support for expanding fossil fuel production, frequently using slogans like “drill, baby, drill” to underscore his priorities.

President Trump’s Appointments and Their Implications for Solar

Chris Wright – Secretary of Energy

President Trump nominated Chris Wright, CEO of Liberty Energy (a company specializing in hydraulic fracturing or ‘fracking’) as Secretary of Energy. Wright is a vocal advocate for oil and gas development, including hydraulic fracturing (‘fracking’), and has expressed skepticism toward climate change and efforts to mitigate it. His leadership may shift the Department of Energy’s focus toward traditional energy sources and deprioritize renewable energy programs.

Doug Burgum – Secretary of the Interior

President Trump tapped North Dakota Governor Doug Burgum to run the newly created National Energy Council and has nominated him to head the Department of the Interior. North Dakota has a history of investing in wind power, so Burgum’s background includes support for fossil fuel development and renewable power. His leadership is anticipated to influence policies on public land use, which could affect the deployment of renewable energy projects, including solar installations, on federally-owned land.

Lee Zeldin – Administrator of the Environmental Protection Agency (EPA)

President Trump appointed former Congressman Lee Zeldin to lead the EPA. Zeldin is expected to oversee deregulatory policies that may impact environmental standards.

During his first presidency, Trump’s administration prioritized deregulation and rollbacks of environmental regulations, attempted to reduce the Environmental Protection Agency’s (EPA’s) budget, and implemented a hiring freeze at the agency. The new administration’s focus on deregulation and support for fossil fuels may result in a less favorable regulatory environment for new solar projects and increase permitting challenges.

Willie Phillips – Chairman of the Federal Energy Regulatory Commission (FERC)

President Trump nominated Willie Phillips, Chairman of the District of Columbia Public Service Commission, to lead the Federal Energy Regulatory Commission (FERC). Phillips, a seasoned regulator with experience in utility law, has emphasized grid reliability and ratepayer protections and has not been a particularly vocal proponent of renewable energy expansion. The appointment of Phillips as chair may influence policies affecting the integration of renewable energy into the grid and further stall already delayed solar projects awaiting interconnection. Under new leadership, FERC may reevaluate transmission incentives and policies that facilitate solar energy projects, potentially creating additional challenges for solar developers seeking grid access.

Republican Lawmakers and Solar Policy

Republican lawmakers have a much more complex view of solar power provisions within the Inflation Reduction Act (IRA) than a simple anti-renewables party line view. While many members of the GOP remain critical of the legislation, several acknowledge that it has benefited their districts and the national economy.

Republican Perspectives on the IRA

Several Republican lawmakers have voiced support for specific clean energy tax credits within the IRA. In a letter to House Speaker Mike Johnson, 18 House Republicans, led by Rep. Andrew Garbarino (N.Y.), warned against repealing energy tax credits, stating that such a move could jeopardize billions of dollars in investments and thousands of jobs. 14 of those representatives have been re-elected.

The group highlighted that energy tax credits have incentivized private investment and supported high-paying jobs. Large-scale clean energy projects tend to be built more in rural areas, so despite the IRA’s passage without Republican votes, it has disproportionately benefited Republican-led districts.

Nearly 60% of all new clean energy and electric vehicle (EV) projects announced under the IRA are based in these districts. These projects account for 85% of the private investment and 68% of the jobs created under the IRA, with Southern states like South Carolina, Georgia, and Texas leading the charge in clean energy development. For Republicans, a full repeal risks alienating constituents who directly benefit from the law.

Republicans are more likely to focus on targeted rollbacks or modifications to specific provisions within the IRA, such as phasing out tax credits earlier than planned or altering domestic content requirements. This approach would allow Republicans to balance fiscal conservatism and constituent benefits without fully reversing the progress made under the IRA.

Federal Incentives and the IRA

The Inflation Reduction Act (IRA)

The IRA was a massive piece of legislation that covered far more than the clean energy industry. In the solar sector specifically, the IRA boosted the Investment Tax Credit (ITC) from 26% to 30% and extended it through 2032. This tax credit incentivizes installing solar panels and domestic manufacturing of solar and other renewable components.

These incentives have accelerated the solar industry by lowering installation costs (and payback periods for consumers and businesses) and boosting investment in domestic solar manufacturing.

It’s unlikely that the Inflation Reduction Act (IRA) will be fully repealed under Trump’s second presidency since it enjoys bipartisan support and has helped revitalize Republican-led districts. However, several critical parts of it could be modified or repealed piecemeal, making it more difficult for solar companies and homeowners to take advantage of federal support for renewable energy.

IRA Provisions That Could Be Changed Under President Trump

- The Investment Tax Credit (ITC) and Production Tax Credit (PTC): These help reduce some of the cost of solar energy projects and are likely targets under the new administration. Though they will be difficult to fully repeal, Republican lawmakers may attempt to phase these credits out by 2025 or 2026 rather than letting them run through 2032 as initially planned.

- Home Energy Rebates: Incentives for energy-efficient home upgrades (like solar panels, heat pumps, and battery backups) could be removed or scaled back as part of the new administration’s plan to scale back government spending.

- EV Tax Credits: President-elect Trump has threatened to axe credits for electric vehicles, stating: “We’re going to stop this nonsense with electric vehicles that no one wants to buy. The government shouldn’t be paying people to drive cars they don’t want.”

- Domestic Content Requirements for ITC/PTC: The Inflation Reduction Act offered a 10% bonus tax credit to clean energy projects using domestic content. The new administration might require renewable energy projects to use domestically manufactured materials to qualify for these credits. In the short term, this would create supply chain challenges for solar companies.

Reduced tax credits and funding could increase solar project costs, slow the pace of solar adoption, and undermine long-term domestic solar manufacturing.

State Policies and Incentives

If federal benefits like the ITC/PTC are phased out or reduced, state-level incentives will be critical to support solar energy.

The Role of State-Level Incentives

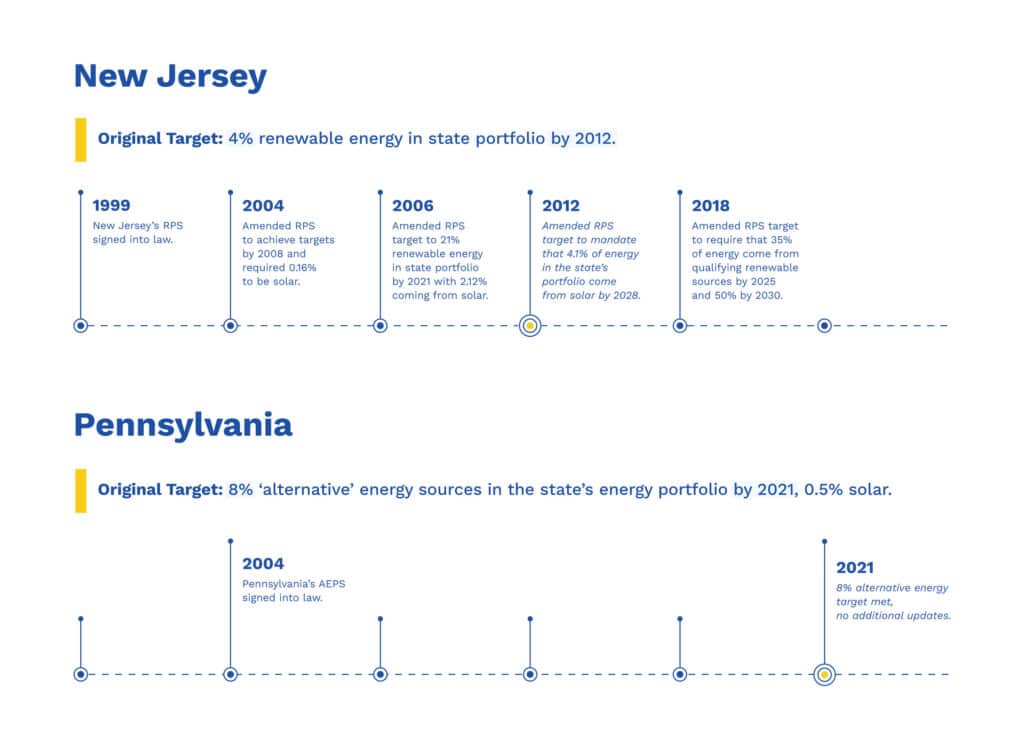

State-level programs like Solar Renewable Energy Certificates (SRECs) have proven essential in fostering the growth of solar energy as incentives have come and gone. New Jersey and Pennsylvania’s SREC programs, for example, allow solar system owners to earn credits for the electricity their systems generate and sell them to utilities.

State governments are also increasingly adopting ambitious renewable energy targets. New Jersey, for example, requires that 35% of the energy sold in the state come from renewable sources by 2025, and 50% by 2030. If federal incentives are repealed under the coming administration, state-level incentives and policies will play a large role in continuing the solar industry’s expansion.

Side-By-Side Comparison of Two States With Different Incentives

Despite having similar climates and populations, New Jersey and Pennsylvania have deployed wildly different amounts of clean energy. New Jersey is a national leader in clean energy, and Pennsylvania has lagged behind.

Two main factors have contributed to the two states’ renewable energy situations:

- New Jersey’s ambitious Renewable Portfolio Standard (RPS) has been updated four times since its enactment in 1999. Each time, legislators have added clear, enforceable targets for renewable energy solar adoption to reflect changing technological trends. By contrast, Pennsylvania has not updated its Alternative Portfolio Standard (AEPS) since it was enacted in 2004.

- Both states have SREC programs, but the value of SRECs varies from state to state. New Jersey offers solar system owners a 15-year fixed price for SRECs, while the price of SRECs in Pennsylvania is subject to supply and demand. Because PA has not updated its renewable standard, there is less demand for SRECs.

New Jersey’s cohesive and sustained support of solar energy has created market stability and made it easier for investors to underwrite projects. In contrast, Pennsylvania’s inconsistent support has created uncertainty that makes long-term investment more difficult. As a result, New Jersey has installed over 4.7 gigawatts of solar capacity, accounting for more than 7% of its electricity consumption.

Pennsylvania has struggled to replicate this success. Currently, the Pennsylvania AEPS requires only 8% of energy from ‘alternative’ (note, not ‘renewable’) sources, with only a 0.5% carve-out for solar. While PA also offers SRECs, the demand is lower due to the state’s less aggressive energy targets. As a result, Pennsylvania has installed only a fraction of the solar capacity seen in New Jersey, with solar contributing less than 1% to the state’s electricity portfolio.

Corporate Commitments

President-elect Trump has explicitly stated that it’s his priority to ensure America has the “lowest cost energy and electricity on earth.” Since solar energy is now the cheapest energy source, it will likely remain a key part of meeting that need in the coming decades.

As more data centers come online, the cryptocurrency sector grows, and more and more people switch to EVs, the demand for electricity will only grow.

The private sector has been a key driving force behind the growth of solar energy in the last decade. The Solar Energy Industries Association (SEIA) recently published its 2024 Solar Means Business report. It shows some of the world’s largest corporations leading private investment in the energy transition.

Meta currently leads the pack with an 11,700 MWdc renewable portfolio, of which 5,177 MWdc comes from solar.

Sitting in the number two spot with 4,668 MWdc of solar resources, Amazon has invested billions of dollars in clean energy, matched 100% of its electricity consumption with renewable energy in 2023, and aims to operate entirely carbon-free by 2040. Large-scale solar farms play a significant role in meeting this target.

Google comes in third with 2,595 MWdc of solar and has pledged to operate entirely on carbon-free energy by 2030.

This growth shows no sign of slowing down. According to SEIA’s report, the top ten corporate solar energy buyers are pursuing a massive 27.8 gigawatts (GWdc) of solar capacity. Leading the charge is Amazon, with 13.6 GWdc of solar projects in the works, followed by Meta with 5.9 GWdc and Google with 5.7 GWdc.

If fully realized over the next few years, this installed capacity from the top ten corporate solar buyers would surpass the total amount of solar power installed across the United States in 2022.

Large corporations will always meet their power demands in whichever way makes the most sense for their bottom line. If the IRA tax credits are repealed, many of these in-progress projects mentioned above may stall or be canceled altogether. However, if President-elect Trump is truly invested in lowering the cost of energy across the country, solar energy will continue to play a key role as power demand increases.

Challenges Facing the Solar Industry for the Next Four Years

The solar industry has grown year over year for the last quarter century and is poised to continue. Policy changes under the new administration are unlikely to derail this progress but could certainly slow it.

Tariffs and grid integration are likely to present economic challenges. President Biden’s existing tariffs on imported solar components and potential new tariffs under the Trump administration could disrupt supply chains and raise developers’ costs.

These tariffs could hinder large-scale solar deployment by making equipment more expensive and limiting access to affordable materials.

Grid Integration

Modernizing the grid remains a critical bottleneck for the solar sector. Sixty percent of U.S. distribution lines have already aged past their 50-year life expectancy. Before the U.S. sends more electricity through this older infrastructure (whether renewable or otherwise), much of it must be updated.

Renewable energy makes the grid more resilient by generating more electricity than is needed during peak times. However, without investments in energy storage, advanced transmission lines, and smart grid technologies, the grid may not be able to handle this increased energy capacity, particularly during peak production times.

Because of outdated infrastructure, utility policies, and slow review timelines, more than 1000 GW of solar projects are awaiting interconnection approval in the U.S. New regulations under the next administration could further delay these projects.

Potential Tariffs and Their Impacts

Under Trump’s administration, new tariffs targeting imported solar panels, components, or related materials could significantly disrupt the industry.

For example, if tariffs on Chinese-made solar panels were increased from current levels or new tariffs were applied to other suppliers, costs for solar equipment would rise. This could stall projects that depend on cost-effective imported materials, particularly utility-scale installations.

Some potential tariffs we could see under the new administration:

- Increased Tariffs on Solar-Related Imports

The Trump administration could increase tariffs on Chinese goods under Section 301 (which President Biden set at 25% and later increased to 50% in August of 2024) to as much as 60-100%. While these tariffs don’t directly target solar modules or cells, they could impact prices on materials like solar glass, wafers, and components essential for U.S.-based solar manufacturing.

Tariffs on semiconductors (including silicon, which is heavily used to make solar cells) are set to double from 25% to 50% in January of 2025 as part of the Biden administration’s 2022 CHIPS Act. - Tariffs on Lithium-Ion Batteries

Tariffs on lithium-ion EV batteries rose from 7.5% to 25% in 2024. Tariffs on lithium-ion non-EV batteries are set to rise from 7.5% to 25% in 2026. However, President Trump could fast-track this increase or raise it dramatically shortly after taking office. This would significantly affect the pricing of battery storage projects. - Uyghur Forced Labor Prevention Act (UFLPA) Enforcement

President Trump may enforce the UFPLA more aggressively, blocking imports of materials like polysilicon, ingots, and wafers from suppliers with ties to forced labor in China. Enforcing this regulation could affect the solar industry’s upstream supply chain. Though solar component detention dropped in 2024, gigawatts of solar components are still detained at U.S. customs under the UFLPA.

What’s Next for Solar

Despite these challenges, the solar industry’s long-term outlook remains optimistic. Falling costs, corporate commitments, and state-level policies will likely sustain the momentum the industry has built over the last few decades.

Solar technology is far more efficient and cheaper than eight years ago. Electricity demand is also rising, projected to grow by more than 3.4% annually through 2026. Much of this demand is fueled by data center development from large technology companies like Meta, which has already offset 100% of its power with renewables and is planning to invest in Gigawatts more.

The outlook for the solar industry as a whole under President Trump’s second term is much more optimistic than in his first. However, navigating the economic and regulatory hurdles of the next four years will still require strategic planning and public advocacy to ensure solar remains a viable energy solution as fossil fuel lobbies attempt to scale it back.

Resilience and Growth

Over the last quarter century, the solar industry has proven resilient and built public support despite economic challenges and ever-changing policies.

The costs of solar technology and energy storage systems have steadily declined, making clean energy more accessible to homeowners and businesses. According to data from NREL, residential solar is more than 16% cheaper than when Donald Trump first took office in 2016. Commercial-scale and utility-scale installation costs have fallen even further, by more than 33% and 62%, respectively.

Advances in battery storage now allow solar energy to be stored when it’s not immediately needed and used later. According to the U.S. Energy Information Administration (EIA), total battery storage nationwide was barely more than 1 GW when Donald Trump took office in 2016. By the end of 2024, the country is expected to pass 30 GW of storage capacity.

These strides have taken place under two administrations with vastly different policies in the last eight years. The infrastructure to support solar adoption vastly differs from eight years ago.

Advocacy and Public Support

Public support and demand for clean energy continue to grow, driven by increasing awareness of climate change and the economic benefits of renewable energy. According to the Pew Research Center, more than 69% of Americans favor expanding renewable energy, compared to only 30% who want to expand natural gas. These numbers are also up from 2016 when renewables made less financial sense.

Going forward, advocacy groups will continue to play a crucial role in translating the public’s voice into action as they work to protect renewable energy policies, promote incentives, and support local solar initiatives under Trump’s second administration.

Public support also encourages corporations and state governments to prioritize renewable energy, creating momentum that federal setbacks cannot easily derail.

What Can Solar Advocates Do?

The Solar Energy Industries Association (SEIA) put out this statement on their website about their lobbying priorities as we head into President Trump’s second term:

“The U.S. solar industry grew by 128% under President Trump’s first term in office, reaching 100 gigawatts (GW) of total installed capacity, enough to power over 17 million homes. This period of growth set the United States on a trajectory to becoming the #2 solar market in the world today with 220 GW on the grid and over 100 solar and storage manufacturing plants across 43 states.

SEIA’s policy agenda includes the following core goals:

Eliminate dependence on China

Surge American solar manufacturing

Meet the demand challenges of data centers, AI, and crypto

Cut red tape in the energy sector

Support energy choice and energy freedom

Protect private property rights

Bring more jobs to America’s heartland”

The above goals all align with the Trump administration’s stated goals. It will be critical, going forward, to focus on the things we agree on.

So, how do we get there?

We protect the Inflation Reduction Act’s tax credits at all costs to encourage private investment in solar infrastructure.

Going forward, securing bipartisan support for renewable energy will be critical. Advocates should focus on framing solar as an economic driver that benefits communities across the political spectrum (rather than a carbon-neutral technology that will slow global warming).

Highlighting job creation, energy independence, and cost savings can appeal to lawmakers who might not prioritize climate change but are heavily invested in economic growth.

Building public awareness is equally important. Advocates can help rally public support by communicating solar’s economic benefits—such as lower energy bills, local job creation, and reduced reliance on volatile fossil fuel markets.

Encouraging consumers to call their local representatives and voice support is critical. Evidence-based appeals are especially powerful. The voice of a rural Republican constituent who went solar five years ago and has saved money as a result is much more likely to be heeded by a Republican lawmaker.

The highest impact any one person can have, however, is investing in solar energy themselves. For some, this means buying a rooftop solar system for their homes. For others, this could mean signing up for a community solar program in their area or starting a conversation with a local installer about building a solar system to power their business.

If you’re in Exact Solar’s service area (Pennsylvania, New Jersey, and Delaware), we’d love to discuss how we can design the best solar system for your unique needs. With power costs rising, solar incentives at an all-time high, and installation costs lower than ever, there’s never been a better time to explore solar energy for your property.

Schedule your free consultation with our experienced team today!