With Donald Trump’s return to the White House and a Republican majority in both the House and Senate, the fate of the American Clean Energy Tax Credits, including solar incentives, hangs in the balance.

At Exact Solar, we’ve received many questions about solar-specific tax credits since Trump took office. Those who are ready to invest in solar energy systems are understandably concerned about what will happen to them during Donald Trump’s second term.

If you’re unfamiliar with these credits, we’ve written about them in-depth before:

A Guide for Homeowners: The 30% Investment Tax Credit (ITC)

The IRA’s Tax Benefits for Commercial Solar

These tax credits have spurred billions in renewable energy investments, particularly in solar, wind, and battery storage. Primarily due to these incentives and falling component costs, the U.S. installed more solar than any other power source in 2025. Solar energy accounted for 81.5% of the new electricity sources added to the grid in 2024.

Clean energy tax incentives have existed for over fifty years and have often enjoyed bipartisan support. These credits face an uncertain future under Trump’s administration, which is committed to reducing federal spending on “green subsidies” and boosting fossil fuel production.

In the coming months, Congress will either reinforce or repeal the clean energy tax credits. In this article, we’ll explain the process Congress will use to support or eliminate the tax credits and show what ordinary citizens who want these credits to remain online can do.

Here’s the Bottom Line

The decisions Congress makes in the coming months will determine whether solar energy remains an accessible and financially viable option for homeowners and businesses. If the Investment Tax Credit (ITC) is repealed, it could slow down solar adoption, increase costs for consumers, and hinder the U.S.’s transition to clean energy.

If you live in Bucks County or Montgomery County and want to see continued investment in solar energy in the U.S., now is the time to act. Representative Brian Fitzpatrick plays a crucial role in these discussions, and hearing from constituents like you can influence his stance.

The best way to get involved is to call Brian Fitzpatrick’s office and set up a meeting. During your meeting, emphasize that maintaining the ITC is crucial for local homeowners, businesses, and the clean energy industry. Ask him to commit to the following statement when speaking with the chairman of the Ways and Means Committee:

“I will not vote for a reconciliation package that eliminates the Investment Tax Credit (ITC) for solar energy projects.”

You can contact his office to set up a meeting using this form or by calling (215) 579-8102.

If you’d like to know more about the reconciliation process and why this will work, continue reading this article!

Table of Contents

Why Solar Incentives Are Important

Solar energy incentives lower the financial barriers that often prevent individuals and businesses from investing in solar energy systems, making it easier for people to choose green energy over fossil fuels. By reducing upfront costs through tax credits, rebates, and other financial benefits, these incentives encourage more widespread installation of renewable energy systems like solar panels and wind turbines.

Solar energy incentives also help democratize energy production. Instead of relying solely on large utilities to control and distribute energy, individuals and communities are empowered to invest in, produce, and sell their own energy.

When consumers add renewable energy sources to the electric grid, the entire grid stabilizes. When large utility companies and interconnection providers refuse to add renewables to their portfolios, energy costs rise for everyone, and the grid’s overall reliability decreases.

The Inflation Reduction Act’s Current Clean Energy Incentives

The Inflation Reduction Act, passed in 2022, was the most significant piece of clean energy legislation in U.S. history. It funneled nearly $400 billion into initiatives to accelerate the transition to renewable energy. This legislation extended several clean energy incentives that were already in place and created several new incentives to boost clean energy adoption.

These credits from the IRA (often referred to as the American Clean Energy Tax Credits) include:

Investment Tax Credit (ITC) – IRC Section 48

The Inflation Reduction Act boosted the ITC to 30% (up from 26%) for solar, wind, and other clean energy projects through 2032. This credit significantly reduces the upfront cost for residential and commercial installations, and it can be further enhanced with bonus credits for meeting prevailing wage and domestic content requirements.

The ITC also introduced a new concept called Elective Pay, which allows non-taxable entities like churches and non-profits to receive tax credits as direct payments.

Production Tax Credit (PTC) – IRC Section 45

Primarily designed for wind energy, the Production Tax Credit (PTC) offers a per‐kilowatt-hour incentive that helps secure long-term revenue stability for renewable power projects by offsetting production costs through a tax credit.

Bonus Credits – Supplemental Provisions in IRC Sections 45 & 48

Additional 10% tax credits are available for projects that meet specific criteria, such as prevailing wage requirements, domestic content mandates, and location-based adders for investments in energy communities. These bonus credits can further increase the overall benefit provided by the ITC and PTC.

Manufacturing Tax Credit – IRC Section 45X

The IRA introduced a tax credit to promote domestic manufacturing of clean energy components (such as solar panels, wind turbines, and battery systems). The credit aims to boost domestic production, create jobs, and further strengthen the renewable energy supply chain.

These incentives have driven investment, created jobs, and lowered energy costs nationwide. Solar installations have surged over recent years, and domestic renewable energy manufacturing has expanded substantially, partly because of the stability provided by these tax credits.

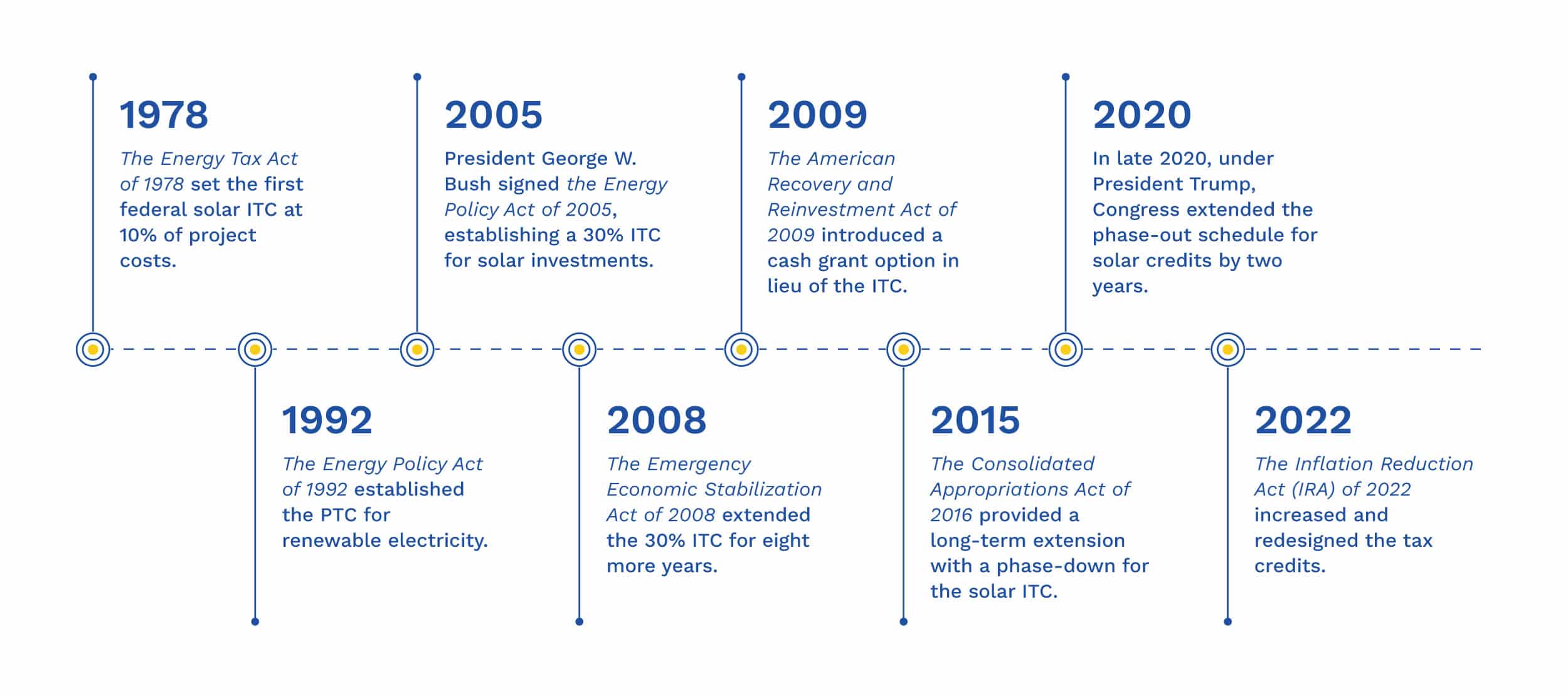

Contrary to popular belief, clean energy tax credits weren’t invented by the Inflation Reduction Act. They’ve been around for over 50 years and have even enjoyed bipartisan support.

A History of Solar Tax Credits

A widely unknown and misunderstood concept is how much energy production is subsidized. The electric grid is complex, and for modern society to function, energy needs to be both affordable and reliable. That’s why governments worldwide provide billions of dollars in tax breaks and incentives to energy companies every year to help maintain grid stability. Fossil fuel companies have benefited from subsidies for over a century.

Solar companies have received support for just over 50 years, but it wasn’t until the Investment Tax Credit (ITC) was set between 20% and 30% in the last two decades that it truly helped drive the industry forward.

Here’s the timeline of American clean energy incentives:

1978 – Under Jimmy Carter, the Energy Tax Act of 1978 set the first federal solar ITC at 10% of project costs. Congress extended and modified this credit through the early 1980s (at one point increasing it to 15% and later phasing it back down to 10%), eventually making a 10% solar ITC permanent in 1992.

1992 – The Energy Policy Act of 1992 established the PTC for renewable electricity. Originally aimed mainly at wind power, it provided 1.5¢ per kWh for the first 10 years of a project’s operation. Solar was not initially eligible for the PTC, but this law reaffirmed the permanent 10% ITC for solar.

2005 – President George W. Bush signed the Energy Policy Act of 2005, a landmark energy bill establishing a 30% ITC for solar investments. This included a new 30% residential solar credit (capped at $2,000 at that time) in addition to the uncapped commercial credit. The 30% rate was initially temporary but was later extended by the Obama administration. Since the Energy Policy Act was signed into law, the solar industry has grown by 200X.

2008 – The Emergency Economic Stabilization Act of 2008 (enacted under President Bush and continued by President Obama) extended the 30% ITC for eight more years and removed the $2,000 cap on the residential credit.

2009 – In response to the financial crisis, the American Recovery and Reinvestment Act of 2009 (Obama administration) introduced a cash grant option (the Section 1603 Treasury Grant Program) in lieu of the ITC. Solar developers could receive a direct grant equal to the credit value, addressing the lack of “tax equity” financing during the recession. This kept solar projects moving forward when many potential tax-credit investors had no profits to offset.

2015 – The Consolidated Appropriations Act of 2016 (enacted Dec 2015 under President Obama) provided a long-term extension with a phase-down for the solar ITC. It maintained the 30% ITC for projects through 2019, then scheduled step-downs: 26% for 2020, 22% for 2021, and thereafter dropping to 10% for commercial and 0% for residential in 2022. Congress chose this approach as part of a bipartisan deal.

2020 – In late 2020, under President Trump, Congress extended the phase-out schedule for solar credits by two years. COVID-19 relief legislation (Dec 2020) kept the ITC at 26% for projects begun in 2021 and 2022 (instead of dropping further), with 22% for those begun in 2023. There was speculation that President Trump might veto this extension, but he ultimately signed it into law.

2022 – The Inflation Reduction Act (IRA) of 2022, passed under President Biden, not only renewed and increased these clean energy tax credits but also redesigned them. It restored the ITC to 30% and guaranteed it for at least a decade, revived the PTC for solar and other renewables, and introduced bonus credits and elective pay.

Trump’s Vision: A Shift Toward Fossil Fuels

President Trump has repeatedly criticized the clean energy tax credits embedded in the IRA, calling them a “green new scam”, vowing to cut them, and then redirect funds toward fossil fuel extraction with his slogan “drill, baby, drill.” His administration is seeking to reduce federal spending on renewable energy incentives and targeting both the ITC and PTC for reform.

Shortly into his first term, Trump paused all unspent Inflation Reduction Act disbursements. This action was part of two larger executive orders, “Declaring an Energy Emergency” and “Unleashing American Energy,” which excluded solar and wind energy from the administration’s definition of energy.

From the executive order:

“(a) The term “energy” or “energy resources” means crude oil, natural gas, lease condensates, natural gas liquids, refined petroleum products, uranium, coal, biofuels, geothermal heat, the kinetic movement of flowing water, and critical minerals, as defined by 30 U.S.C. 1606 (a)(3).”

This directive ordered agencies to halt funding (including for projects already under contract) to allow for a “review of disbursement processes.”

The funding freeze has left many large-scale projects in limbo, causing delays and cancellations. Contractors, nonprofits, local governments, and even Native American tribes have reported halted funding, and some have had to lay off employees and halt operations.

The Office of Management and Budget has directed agencies to pause grants and loans in several areas, including climate, energy, and infrastructure projects.

With funding on hold, many federally obligated projects face cancellation or significant delays, which can have broader economic repercussions. This can disrupt local economies and undermine long-term planning for energy and infrastructure improvements.

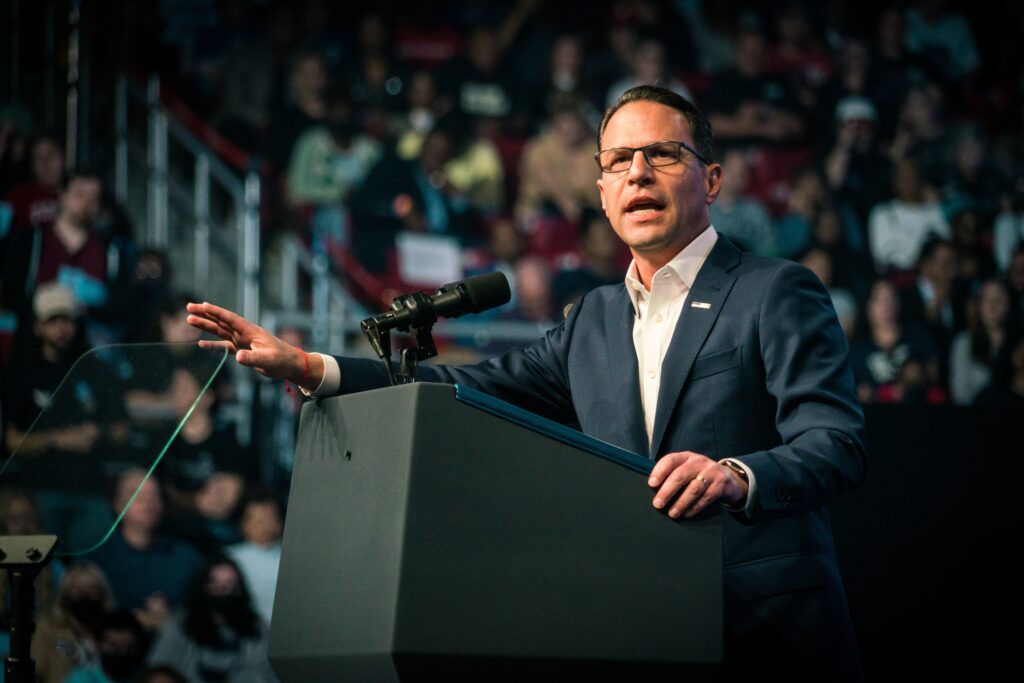

Thankfully, some of the frozen federal funding has recently started flowing again. Pennsylvania Governor Josh Shapiro managed to unfreeze $2 Billion in funding earmarked for his state with a lawsuit against the administration. He reiterated in a recent statement that the freezing of federal funds appropriated by Congress is illegal, saying, “You don’t need to be a former attorney general or even a lawyer to understand this.”

How Congress’s Budget Resolution and Reconciliation Will Affect Solar Incentives

After November’s election, Congress has a very slim Republican majority. The House and Senate will ultimately decide the future of clean energy tax credits as they rewrite the federal budget to align with the new administration’s priorities.

They’ll likely attempt to remove some or all of the tax credits from the budget through a process called “reconciliation,” in which they can pass new legislation with a simple majority.

If congressional representatives don’t hear from their constituents that they support these tax credits, they’ll likely target them for repeal in their reconciliation process to make room in the budget for other agenda items.

Here is a very high-level overview of how this process works:

How Budget Resolutions and Reconciliation Work Together

- Budget Resolution Sets Blueprint

The House and Senate adopt a budget resolution outlining spending limits and revenue targets. While non-binding, it provides the fiscal framework for all subsequent legislation. - Committees Receive Instructions to Draft Legislation

Once the resolution is approved, congressional committees receive specific guidelines for drafting legislation that meets the set parameters. These instructions determine the limits on spending and revenue changes for various programs, including any and all tax credits. - Reconciliation is Used as a Legislative Shortcut

The reconciliation process allows Congress to bypass the filibuster by requiring only a simple majority. This procedure bundles budgetary changes (such as repealing or scaling back solar tax credits) into a single bill that adheres to the fiscal limits set by the budget resolution.

On Tuesday, February 25th, 2025, House Republicans passed a budget resolution that sets the stage for executing President Trump’s domestic agenda through the reconciliation process.

This framework includes a plan to implement $4.5 trillion in tax cuts and mandates $2 trillion in spending cuts. The resolution also calls for measures such as increased funding for border security, a boost in military spending, and a $4 trillion raise in the nation’s debt limit.

The measure passed with a razor-thin margin of 217-215 after intense negotiations swayed several holdout members.

With the budget resolution now in place, committees will draft the specific legislative text that achieves these spending cuts.

So, as committees decide what to cut, now is the time to act to protect solar energy tax credits.

How Ordinary Citizens Can Protect the Tax Credits

Efforts to protect clean energy tax credits are happening nationwide, and your voice matters.

At Exact Solar, we’ve been working closely with the Solar Energy Industries Association (SEIA) to advocate for these credits and ensure they remain in place. Our team joined thousands of other solar companies in signing a letter to local representatives, and we’ve met with our local representative’s office to emphasize their importance.

We can’t stop there. Protecting these tax credits requires community action.

If you support clean energy and want to see continued investment in solar technology, it is critical that you contact your Congressional Representative and urge them to keep clean energy tax credits intact.

For Pennsylvania residents that live in Bucks County or Montgomery County, where Exact Solar is based, your representative is Brian Fitzpatrick.

You can reach his office to set up a meeting using this form or by calling (215) 579-8102.

If you live outside of these counties, you can use this tool to locate your own local representative. Call or email their office to set up a meeting, and ask them to commit to supporting clean energy tax credits.