Across the country, almost every industry is bracing for the impact of President Trump’s tariffs, and the solar industry is no exception. If you’ve been thinking about making the switch to solar, you may have seen headlines like “Solar Panel Prices Are Rising Again” and wondered if you missed the window for getting the best deal.

Don’t worry, you haven’t missed out! Tariffs on solar components are nothing new.

In fact, many solar installers and developers, including Exact Solar, have a stockpile of panels purchased before the tariffs took effect. This means prices are unlikely to rise sharply for a few more months. While it’s true that some lawmakers are pushing to repeal solar tax credits, there’s still strong opposition to that effort.

So, yes, there is political uncertainty, but that’s not something new for the solar industry. Going solar remains one of the smartest long-term investments you can make, and at Exact Solar, we’ve been through our fair share of policy changes, tariffs, and market shifts over the last 20 years. Our commitment has always been to install high-quality solar systems that deliver lasting value for our customers.

At Exact Solar, our team is deeply invested in staying ahead of these changes. We’ve been actively researching the potential impacts of tariffs and tax credits, and we’re working hard to advocate for policies that benefit our customers. Based on our findings, we’ve determined that these potential price increases would likely add only a few months, or at most, a year to your payback period.

When you consider the rising electricity costs across Pennsylvania, New Jersey, and Delaware due to utility rate hikes and PJM’s capacity auction results, going solar remains one of the best ways to protect yourself against these increases.

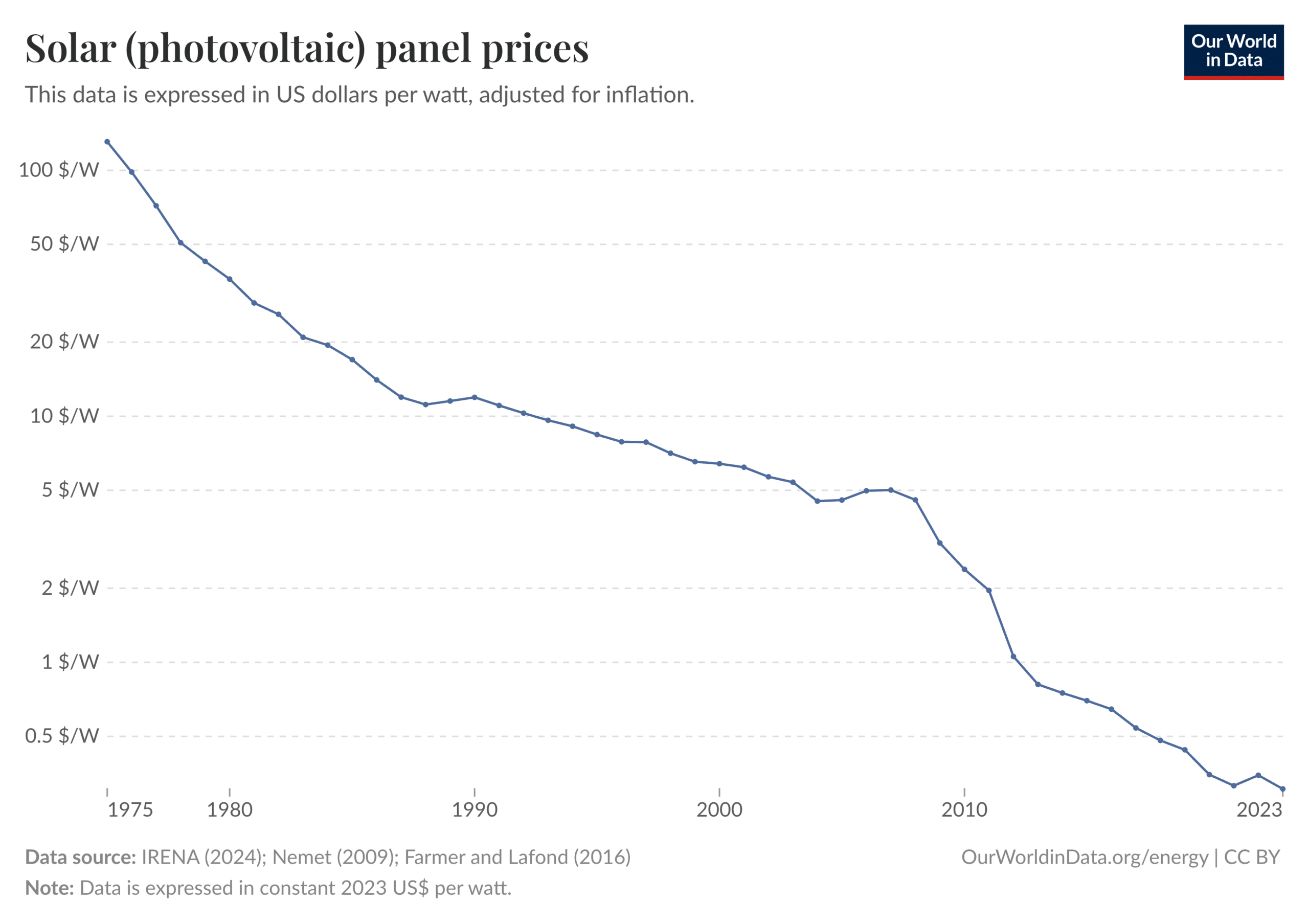

Over the years, solar has been on a consistent upward trajectory, both in terms of quality and affordability. From 2010 to 2020, the cost of residential solar systems in the U.S. fell by 64%. Looking back even further, in 1975, solar panels cost more than $130 per watt; today, they cost just 31 cents per watt. In that time, solar energy went from a fringe solution to a mainstream energy source.

In the wake of the COVID-19 pandemic, that trend temporarily reversed. In 2022, we saw a slight increase in solar costs due to a combination of supply chain disruptions, inflation, and tariffs. While this is the first significant price increase in over a decade, it’s important to note that the long-term trend of falling prices remains intact.

In 2025, new tariffs on imported solar panels, inverters, and batteries may result in modest price increases. At the same time, there is ongoing discussion about the future of the 30% federal solar Investment Tax Credit (ITC), one of the industry’s most important incentives that has helped make solar so affordable. But despite these challenges, the fundamentals of solar remain strong, and 2025 is still shaping up to be an excellent year to go solar.

In this article, we’ll explore what’s behind the rising costs, what’s happening with tariffs and tax credits, and why now is still a great time to make the switch to solar.

Table of Contents

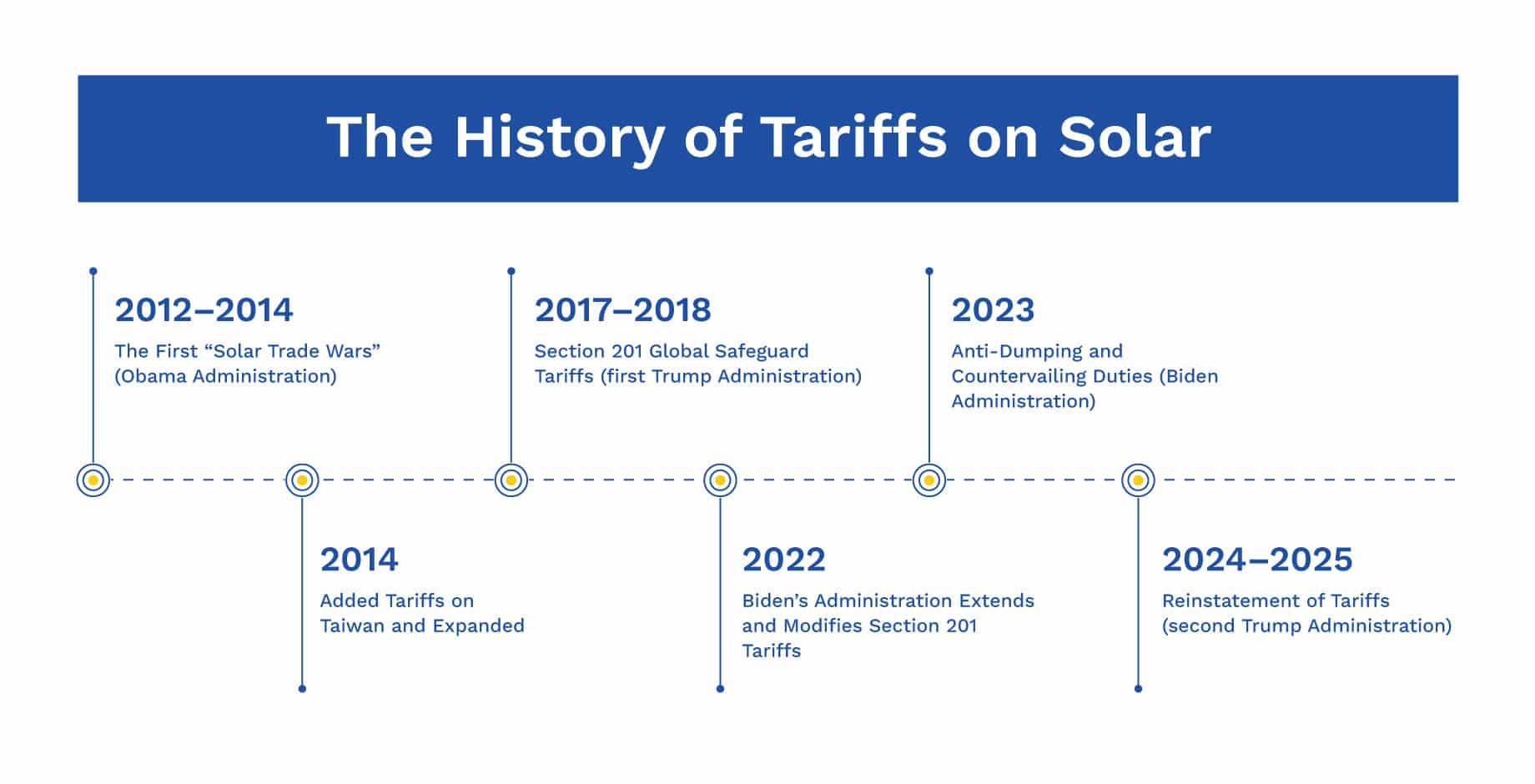

The History of Tariffs on Solar

Tariffs on imported solar components are not a new issue. In fact, they weren’t even initially implemented by Trump’s first administration. The first tariffs on solar components were introduced under the Obama administration, driven by logical reasons that we’ll explain below.

2012–2014: The First “Solar Trade Wars”

U.S. tariffs on solar components began with a landmark case in 2011. SolarWorld Americas, then a major U.S. manufacturer and a subsidiary of Germany-based SolarWorld AG, filed a formal complaint with the U.S. Department of Commerce and the International Trade Commission (ITC).

They alleged that Chinese solar producers, backed by aggressive state subsidies and access to ultra-low-interest loans, were dumping panels into the U.S. market at artificially low prices to undercut American competitors.

In response, the Obama administration levied tariffs on several Chinese solar manufacturers.

2012: Initial Tariffs on Chinese Solar Products

In 2012, the U.S. government sided with SolarWorld, imposing a combination of anti-dumping and countervailing duties on Chinese-made solar cells and modules. These duties averaged approximately 31% but varied significantly by manufacturer, with some charged up to 40%.

2014: Added Tariffs on Taiwan and Expanded Duties

Chinese solar firms quickly adapted. To circumvent the new tariffs, many shifted cell production to Taiwan and other Southeast Asian nations, assembling final modules outside of China and importing them to the U.S. tariff-free. This is a common practice, known informally as “country hopping,” and one reason tariffs haven’t been effective historically.

In response, SolarWorld filed a second petition. In 2014, the Department of Commerce broadened its tariff enforcement to include Taiwanese-made solar cells used in Chinese panels. This second round of duties reached as high as 50% for some Taiwanese companies.

2017–2018: Section 201 Global Safeguard Tariffs

In April 2017, U.S. solar manufacturers Suniva and SolarWorld, facing financial challenges, petitioned for relief under Section 201 of the Trade Act. They contended again that a surge in low-cost solar imports was harming domestic producers, as it had in 2012 and 2014.

In response, the Trump administration imposed a 30% tariff on most imported crystalline silicon photovoltaic (CSPV) modules and cells in January 2018, regardless of their country of origin. These tariffs were structured to decrease by 5% annually, reaching 15% by 2021.

2022: Biden’s Administration Extends and Modifies Section 201 Tariffs

In February 2022, the Biden administration extended the Section 201 tariffs for an additional four years. The tariff rate was reduced to approximately 14.75% for the remainder of the year, with a gradual decrease planned over the extension period.

An exemption was maintained for bifacial solar panels, which are used in ground-mounted and utility-scale projects, allowing them to be imported without tariffs. The annual import quota for tariff-free solar cells was increased from 2.5 gigawatts (GW) to 5 gigawatts (GW).

2023: Anti-Dumping and Countervailing Duties

In 2023, the U.S. Department of Commerce concluded investigations into whether Chinese solar manufacturers were circumventing existing tariffs by routing products through Southeast Asian countries.

The findings confirmed that certain companies in Vietnam, Thailand, Malaysia, and Cambodia were indeed circumventing duties. As a result, the Biden Administration applied the original anti-dumping and countervailing duties to these companies, some of which exceeded 50%.

2024–2025: Reinstatement of Tariffs by the Trump Administration

As of 2025, the Trump Administration has levied a 15% safeguard duty on most CSPV modules, including bifacial panels. Anti-dumping and countervailing duties remain in place for specific imports from Southeast Asia, and the administration has levied section 301 tariffs on Chinese solar products, which have recently have increased to 50%.

How Will New Tariffs Affect Solar Energy Pricing?

Like many industries, the solar industry constantly navigates a changing trade environment. Section 201 tariffs, first introduced in 2018 and extended by the Biden Administration, are still in place at a reduced rate, now around 15 percent. Additionally, tariffs on Southeast Asian solar imports have taken effect.

Together, these policies may increase the cost of imported panels by 15% to 50%, depending on the supplier and component type. At first glance, that might sound concerning. But here’s the good news: We’ve seen this before, and the solar industry has continued to thrive.

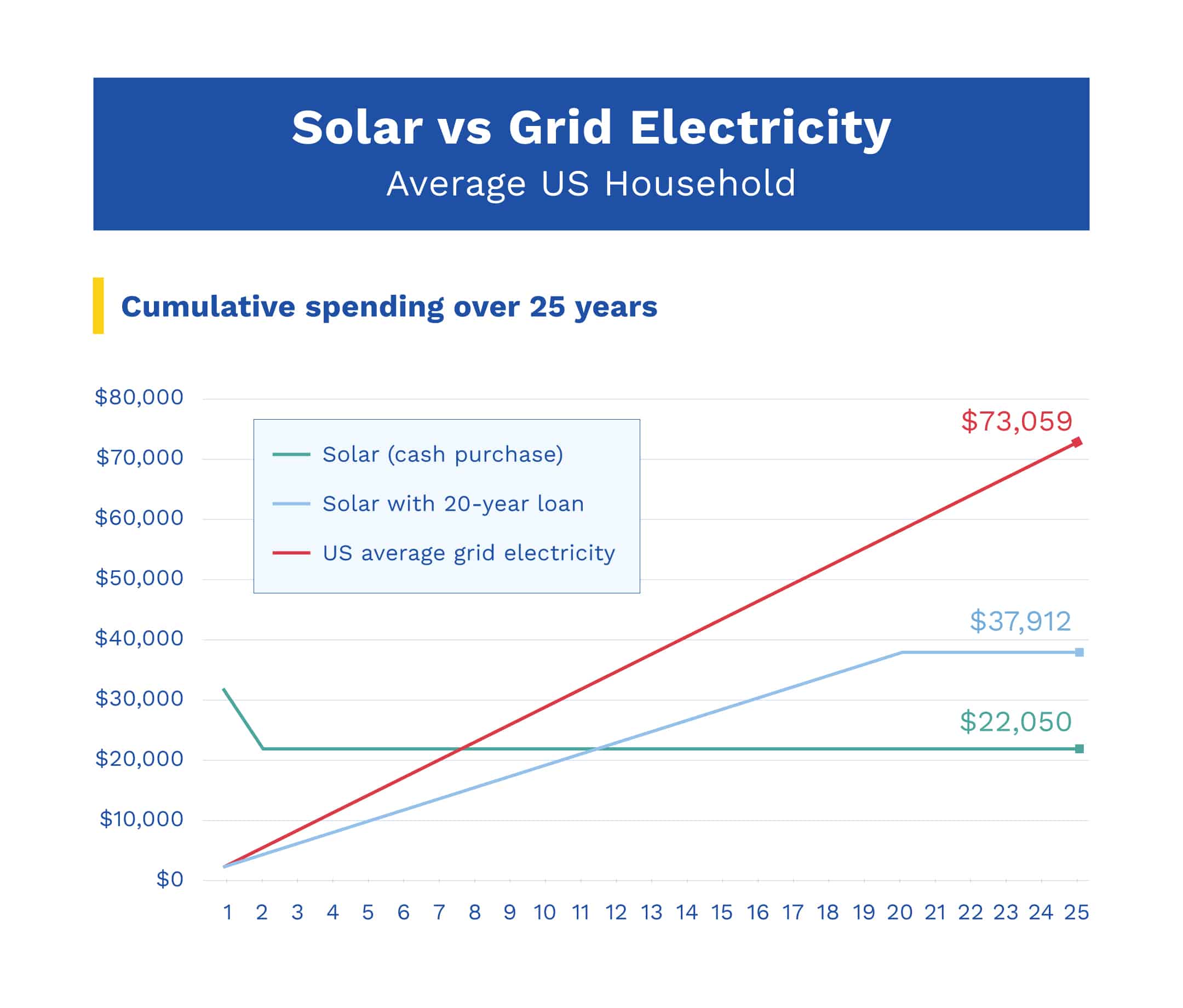

Even with modest increases in panel costs, solar remains significantly cheaper over time than staying tied to a grid with rising utility rates. Anyone who goes solar is locking in a fixed energy cost for their home or business for 25 to 30 years.

How Tariffs Have Previously Impacted the Solar Industry

During the last round of tariffs, many predicted doom for the solar industry. Instead, the industry adapted. Manufacturers diversified their supply chains, and installers became more savvy about sourcing and scheduling. Most importantly, demand never disappeared because solar energy still made economic sense.

That remains true today.

In 2018, the Trump administration imposed a 30% tariff on imported crystalline-silicon solar panels and cells under Section 201. These tariffs were intended to protect American manufacturers from what the administration called “unfair foreign competition.”

While the intent was to stimulate U.S. solar production, the impact, in practice, was significantly higher solar equipment costs.

That year, solar installations slowed. According to data from the Solar Energy Industries Association (SEIA), the industry saw a notable dip as developers delayed or canceled large projects. An estimated 10.5 gigawatts (GW) of planned capacity wasn’t built due to the tariffs. U.S. solar jobs declined 3.2% in 2018, marking the first year-over-year job loss since the industry’s early days of rapid growth.

While the tariffs did encourage a few companies to start manufacturing domestically, such as Hanwha Q CELLS (which opened a facility in Georgia in 2019), domestic panel production could only meet about 15-20 percent of national demand.

The supposed boom in U.S. solar manufacturing didn’t materialize at scale. “Tariffs increased U.S. panel prices but yielded only limited manufacturing gains,” Canary Media summarized. The SEIA echoed this concern in a 2019 statement: “The tariffs have had the unfortunate effect of slowing down solar adoption in America.”

Still, the solar industry proved remarkably resilient. After the initial dip, installations rebounded by 2019. Consumers and businesses continued to invest in solar energy for the same reason they always have: it reduces energy bills and provides long-term energy stability.

The solar industry will always find ways to adapt and grow.

Why 2025 is Still the Best Year to Go Solar

The industry has planned ahead to make sure we can cover solar cost increases. Installers and developers all over the country, including Exact Solar, stockpiled before the tariffs hit and are now sitting on more than 50 GW of solar components nationwide.

With the 30% tax credit on solar installations still in place and a stockpile of lower-cost components still available across the industry, now is the time to go solar.

Tariffs will eventually ripple downstream. Once existing inventories are exhausted, companies will need to pass along some of those higher material costs. Solar panels make up roughly 30 percent of a system’s total cost, on average. If a 20 percent tariff is applied to panel imports, that results in about a 6 percent overall price increase. For a $20,000 residential solar system, that’s an extra $1200.

However, it’s not just solar panels that are subject to tariffs. Tariffs also affect inverters and batteries, and far fewer of these components are made in the U.S.

Companies like Enphase are now manufacturing and shipping inverters in the United States. However, many components of those inverters (such as microchips and resistors) are made in Asia and are subject to price increases due to tariffs.

Home energy storage solutions (batteries) like the Tesla Powerwall rely on lithium-ion battery cells, many of which are sourced from Asia and subject to tariffs of 15 to 25 percent.

Despite the turbulence, demand remains strong, and inventory is still available. For consumers ready to switch to solar, the window of opportunity is still wide open.

Rising Energy Prices Make Solar a Great Investment

For homeowners and businesses across Pennsylvania, New Jersey, and Delaware, the cost of electricity continues to rise.

In New Jersey, Public Service Electric & Gas (PSE&G) was approved for a rate increase in 2023 that raised the average customer’s bill by about $15 per month. Delaware’s Delmarva Power has seen multiple distribution and supply cost increases between 2022 and 2024, with more expected. In Southeast Pennsylvania, PECO has been approved to raise rates by 14% over the next two years.

Capacity auction results from PJM (the regional grid operator) suggest that, due to a failure to connect renewable projects to the grid, they’ll need to pass $14.7 billion onto their customers. Natural gas powers much of the PJM grid. When gas prices spike, electricity rates follow. That was painfully clear in 2022, when natural gas price volatility triggered double-digit percentage increases in electricity bills.

PJM sells energy directly to the utilities, so utilities will need to raise prices even more to cover those costs.

For anyone who invests in solar energy, none of these price increases matter! You opt out of all future increases for 25-30 years. Once your panels have paid for themselves, all future energy from that point on is free and 100% owned by you.

Clean Energy Tax Credits and Incentives May Be Repealed

The Inflation Reduction Act restored the federal solar Investment Tax Credit (ITC) to 30% through 2032. But recent activity in Congress threatens that timeline. Republican budget proposals and Trump-aligned energy plans have floated the idea of phasing down or eliminating these credits sooner.

New Jersey offers one of the most generous solar incentive programs in the country. Through its Successor Solar Incentive Program (SuSi), homeowners and businesses earn payments for every kilowatt-hour their systems produce. The terms of the program could tighten as the state approaches its renewable energy goals.

In Pennsylvania, the value of SRECs fluctuates based on demand, and the state’s AEPS (Alternative Energy Portfolio Standard) hasn’t been updated in years. If the state’s renewable energy goals aren’t updated soon, the value of SRECs could drop significantly.

If these incentives go offline, it might mean significant price increases for those considering solar energy.

Going Solar Now Still Makes Sense

Despite all the noise, the value proposition of solar hasn’t changed. Yes, panel prices could rise. Yes, federal incentives could change. However, the economics still overwhelmingly favor going solar.

The 30% federal solar tax credit remains in place, and net metering policies in Pennsylvania, New Jersey, and Delaware remain favorable. Many installers still have access to pre-tariff inventory. Homeowners and business owners can lock in lower costs today before the next round of price hikes or regulatory shifts hits the market.

If you’re considering solar, now is the time to speak to a reliable, well-reviewed local installer.

If you’re ready to explore the benefits of solar for your home or business, contact our team for a free estimate!