For many homeowners, electricity bills in Pennsylvania, New Jersey, and Delaware are set to increase by at least 20% over the next two years.

These rate increases continue a troubling trend: since 2020, electricity prices have outpaced the record inflation percentages the U.S. has experienced. This increase is due to utility rate increases and PJM’s 2025-2026 capacity market auction results (we’ll expand on this later in the article).

Utilities that are raising their rates or have applied to raise their rates include:

- PECO

- Delmarva Power

- PSE&G

- PPL Electric Utilities

- Jersey Central Power & Light

- Atlantic City Electric

One of the strongest arguments for owning a solar power system is that your power company can’t raise your electricity bill once your system is installed. Once you own a solar system, you own a power-generating asset that takes care of most or all of your home’s electricity needs. The going rate for electricity stops being important to your household.

“When I made that good decision to get solar panels, I knew over time my utility would be raising its rates. But since I don’t get bills anymore, I don’t even bother finding out about their price hikes. But someone told me that sure enough, they are raising their rates yet again soon. So my advice to folks is to call Exact Solar today and start the process of getting solar panels installed on your home.

Then you can be like me and not worry about checking the news to learn about the latest PECO rate hikes. Instead, you will be checking your savings account to see how much extra money rolled in because of these wonderful solar panels. And you will never have to worry about paying high electric bills ever again!”– Steve Cickay, a homeowner in Newtown, PA who went solar with Exact Solar in 2019

As energy prices continue to rise, solar power remains a much more predictable and affordable alternative to relying on the grid. Knowing that record price increases are coming next year, many homeowners are starting the planning and permitting process required to invest in rooftop solar.

In this article, we’ll unpack why rates are increasing and show you how to fight back with low-cost renewable energy from the sun.

Click the links below to go directly to your utility provider:

Delmarva Power’s Rate Increases

PPL Electric Utilities’ Rate Increases

Jersey Central Power & Light’s Rate Increase

Atlantic City Electric’s Rate Increase

PJM’s Role in the Rate Increases

Why Are Energy Prices Rising?

There are two reasons for the energy price hikes:

- Utility companies across Pennsylvania, New Jersey, and Delaware are either planning to raise their prices in 2025 or have raised them by double-digit percentages in the last few years.

- PJM Interconnection’s capacity auction (explained in-depth in the next section) for 2025-2026 is set to pass along nearly $14.7 billion in costs to their customers in June of 2025. This cost increase is projected to raise the average electric bill by at least 10% across PJM’s 13-state service area over the next two years.

To put this in context, the average residential customer in the U.S. pays $136/month ($1632/year) for using 900 kWh monthly.

These rate increases mean that some homeowners will be paying $500 more in energy bills annually by the end of 2026, bringing their annual electric bill above $2000. For the same power and infrastructure they already use.

Low-income households may be hit particularly hard by these increases.

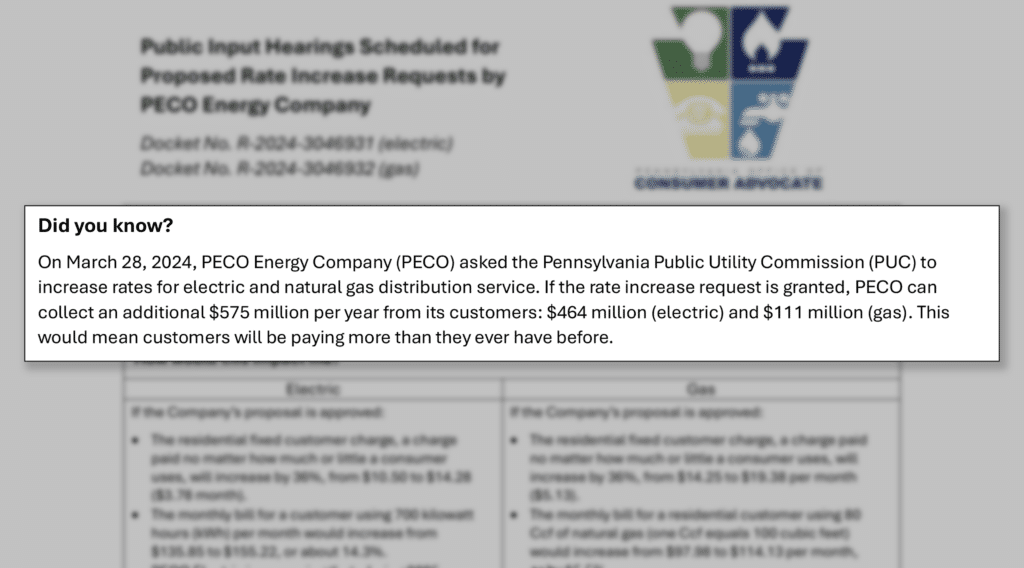

PECO’s Rate Increases

PECO, the utility responsible for delivering power to Philadelphia and surrounding areas, proposed a rate increase of $464 million that will go into effect in January 2025, pending PUC’s approval. If passed, this will raise the average customer in their service area’s bill by 12.3% in 2025 and 1.7% in 2026.

Even though consumer advocacy groups and organizations like the Pennsylvania Public Utility Commission (PAPUC) are reviewing PECO’s request, it’s likely that at least a portion of these rate increases will be approved, leaving customers to cover the rising costs of energy distribution and capacity fees.

Although the PAPUC may opt to spread the increase out a bit longer, this will translate to an additional $20.40 monthly, or about $245 more annually, for the average residential customer. PECO is also planning a more minor price increase of 1.77% per month in 2026.

Delmarva Power’s Rate Increases

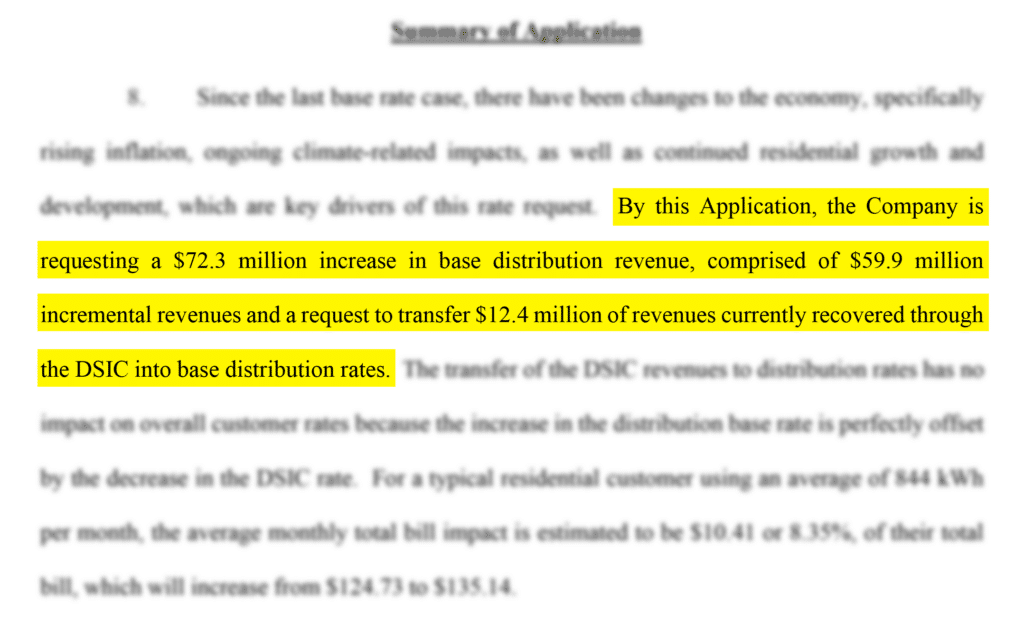

In December 2022, Delmarva Power filed a request with the Delaware Public Service Commission (PSC) for a $72.3 million rate increase to offset infrastructure improvements and rising operational costs.

This will lead to an 8.35% rise for typical residential customers if approved.

The rate hike comes in response to Delmarva’s plans to invest approximately $430 million into system reliability improvements, a 155% increase over previous years’ spending. The company argues that this investment is necessary to maintain service quality amid increasing climate-related disruptions and natural disasters.

Even though the final decision on the rate hike is still pending, temporary rate increases went into effect in July 2023, allowing Delmarva Power to begin collecting part of the requested increase.

This pending decision follows a previous, more minor $16.7 million rate increase approved by the PSC in August 2021, which raised electric distribution rates but was far less than the amount initially requested by the utility.

The new rate increase has faced significant pushback from consumer groups like the Delaware Public Advocate, who argue that the hike is unaffordable for many households already struggling with high utility costs.

PSE&G’s Rate Increases

In 2024, the New Jersey Board of Public Utilities (BPU) approved PSE&G’s first rate increase in six years, which led to a price increase of approximately $15/month per customer.

The approved increase, which took effect on October 15, 2024, resulted in a 7% increase in combined electric and gas bills for typical residential customers.

Now that their 2024 increase has been approved, PSE&G has filed another rate case, seeking to recover over $3 billion in capital investments they’ve made in recent years. The proposed rate hike, still under review, requests an overall 9% increase, raising bills by approximately $25 per month for typical residential customers.

The New Jersey BPU is currently evaluating the proposal, with a decision expected in the coming months.

PPL Electric Utilities’ Rate Increases

In 2022, PPL notified customers of a change that added $34 per month to average residential bills.

This 38% increase in the default electricity supply rate, which went into effect on June 1, 2022, changed the rate from 8.941 cents per kilowatt-hour (kWh) to 12.366 cents per kWh.

PPL has also applied to increase its Distribution System Improvement Charge (DSIC), which covers the costs of maintaining and upgrading local infrastructure, such as substations and transformers. In 2023, the utility proposed raising the maximum DSIC charge from 5% to 9% as part of its ongoing efforts to enhance grid reliability and ensure capacity for future electricity demand.

This increase is still under review by the PAPUC, but if granted, it will likely add an additional 1.4% to the average customer’s monthly bill.

Jersey Central Power & Light’s Rate Increase

Jersey Central Power and Light has filed a request to increase the average residential bill by approximately $8.45 per month if approved.

In 2023, JCP&L filed a request with the BPU for a 7.5% rate increase to recover $185 million in capital investments made to modernize its electric grid and introduce new customer assistance programs.

A settlement related to this rate increase was reached in February 2024, but it is still pending final approval by the BPU.

Atlantic City Electric’s Rate Increase

Atlantic City Electric’s customers already pay the highest energy rates in the state. Record summer heat waves have strained aging infrastructure and caused the company to apply for rate increases to install updates.

In July 2023, the New Jersey Board of Public Utilities (BPU) approved Atlantic City Electric’s $93.1 million Powering the Future program. As part of the plan, customers will see gradual rate changes over four years, starting in 2023. For the typical residential customer, this translates to an increase of approximately $1.22 per month

In addition, ACE customers experienced a 4.8% rate increase in June 2024 due to the state’s annual electricity auction, which affects all New Jersey utility companies. This increase raised the average monthly bill by about $7.34 for residential customers, contributing to rising electricity costs across the state. In 2023, a similar auction led to a 4.1% increase for ACE customers.

PJM’s Role in the Rate Increases

Update as of January 28, 2025

PJM Interconnection has agreed to introduce a price cap for its 2026/27 and 2027/28 capacity auctions, following concerns from Pennsylvania Governor Josh Shapiro about last year’s record-high prices unfairly impacting consumers. While this cap could potentially reduce costs by an estimated $21 billion over two years, it still needs approval from PJM’s stakeholders, board, and the Federal Energy Regulatory Commission. However, this is only a temporary fix. PJM still has one of the largest backlogs in the country for connecting new renewable energy projects. Without real investment in clean energy infrastructure, consumers will continue to bear the costs of an outdated system.

Behind most major utility providers in the U.S., there’s a Regional Transmission Organization (RTO). An RTO is like a traffic controller for electricity. It’s an organization that manages and coordinates the flow of electricity across large areas (often several states). The RTO ensures electricity gets from power plants to homes and businesses smoothly, balancing supply and demand to keep the power grid stable.

PJM Interconnection is the largest RTO in the U.S., managing the flow of electricity to over 65 million people across 13 states and the District of Columbia. PJM ensures the electric grid’s reliability by managing the buying and selling of electricity in real-time and long-term markets.

The RTO is like a traffic manager traffic manager that directs electricity instead of cars. They decide which routes to send electricity along to keep power reliable and affordable across huge regions. They help ensure supply always meets demand by managing electricity transmission over high-voltage power lines.

They also conduct “capacity auctions” to ensure enough power is generated to meet future demand.

The capacity market auctions that PJM runs each year ensure their service area will have enough power to meet peak demand during the hottest and coldest days of the year. Power plants bid in this auction, guaranteeing they’ll be available when needed most, and customers pay a fee to cover these “capacity commitments.”

In July 2024, PJM’s auction for the 2025-2026 period shocked the market with a massive price hike. The total cost of capacity surged to nearly $14.7 billion (from $2.2 billion last year), leaving customers across PJM’s footprint, including people in PECO’s service area, to shoulder these additional costs.

Why the sudden spike? There are three simple answers: the gradual yet predictable continued decline in reliability across fossil fuel plants, PJM’s delays in connecting renewable energy sources to the grid, and the gradual yet significant increases in electricity demand as EVs and “electrification” continue to grow strong and large companies invest in data centers across the country.

More demand is being placed on outdated fossil fuel systems, and renewable capacity isn’t being added to the grid fast enough to balance it out.

Fossil fuel plants, especially natural gas facilities, have proven unreliable during extreme weather events. 2022’s Winter Storm Elliott is a prime example of gas plants failing to deliver during peak demand due to a lack of infrastructure and reliance on fossil fuels. This extreme weather event left thousands without power in below-zero temperatures, exposing customers to outages and higher costs.

Since fossil fuel plants can no longer be considered entirely reliable, PJM changed how they evaluate grid reliability last year. Under their new standards, 26 GW of their natural gas and coal resources have been shown to be “unreliable” because they can’t operate at their total output in all weather conditions.

Because they couldn’t count those 26 GW towards their total capacity, the cost of ensuring capacity for their distributors spiked. Now, consumers in their service area will experience double-digit percentage price increases for power.

As extreme weather events increase and we move away from coal-fired power plants, the need for a robust grid made up of a variety of reliable power sources is evident. Yet PJM has been slow to approve hundreds of Gigawatts of clean energy projects in their queue, instead relying almost entirely on fossil fuel-burning power plants. Due to their slow regulatory processes, these renewable resources haven’t been connected to the grid in time to meet rising demand. Some renewable projects have been approved by PJM—but have yet to be built.

As a result, customers are paying higher prices for less reliable power. PJM’s reliance on fossil fuels has created an expensive and increasingly fragile system.

Now is the Time to Invest in Solar

As a homeowner or commercial property owner, you can opt out of ever-increasing electricity prices and strengthen the overall grid by investing in solar power.

A well-built solar system will save the owner tens or even hundreds of thousands of dollars over its lifetime. But solar systems don’t just save money. They earn the owner money through various incentive programs.

“I was averaging over $200 a month for my PECO electric bills with spikes in the winter to keep my house warm and spikes in the summer to keep my house cool. Often to save a few bucks, I would adjust the thermostat for our electric heat pump and settle for being too cold or too hot. That was not fun at all. Five years later, it looks like I made the right decision. I haven’t had to pay PECO a nickel.

In fact, I get refund checks from PECO every year because my solar panels produce more energy than I use. When my wife says she is either too cold or too hot, I adjust the thermostat immediately! Who cares? I am getting free energy from the sun! Oh, and due to the state SREC program, I get money deposited into my savings account every month. Yesterday I checked my balance and saw $96.25 extra in my account!”

– Steve Cickay, a Newtown homeowner who went solar in 2019

With power costs rising, customers’ return on investment from “going solar” may range from 200% to 400% or more, depending on the specific system and local utility cost.

Here’s why now is the perfect time to go solar:

- The cost of going solar has decreased significantly

The cost of solar system components has steadily declined over the past decade. When compared against rising electricity rates, homeowners now see a return on their investment faster than ever before. - Federal incentives are at an all-time high

The Federal Investment Tax Credit (ITC) remains one of the most substantial incentives for going solar. Homeowners and commercial property owners can claim 30% of their total solar system costs as a tax deduction, reducing the overall financial burden. - Solar Renewable Energy Certificates (SRECs) and Net Metering

In Pennsylvania, New Jersey, and Delaware, homeowners can benefit from Solar Renewable Energy Certificates (SRECs). These certificates allow solar system owners to sell credits for each megawatt-hour of electricity generated, creating an additional income stream on top of the savings from lower energy bills.

Each of these states also has their own net metering programs. Net metering is a billing arrangement that allows homeowners or businesses with solar panels to send excess electricity they generate back to the grid. In return, they receive credits on their utility bill, which can offset the cost of the electricity they consume from the grid during nighttime or cloudy days. - Favorable solar financing options

As lending rates continue to drop, homeowners can lock in affordable financing options for their solar installations. Clean Energy Credit Union offers refinancing options as low as $100, allowing customers to lower their loan rates as soon as interest rates fall.

No Reason to Wait to Go Solar

“There are so many benefits of going solar. First, you can reduce your environmental impact, lower air pollution, and help combat climate change. Second, going solar can drastically reduce or even totally cover your electricity costs. And if you add storage too, you can help capture additional clean energy; provide reliable, consistent backup power; and build resilience to climate-related outages and variables such as rising energy costs.

With federal tax credits and incentives, going solar is more affordable than ever. So there’s never been a better time to power your life with the sun!”

– Flora Cardoni, Deputy Director of PennEnvironment

Energy prices are set to rise significantly in 2025 and 2026. Solar power offers a stable, affordable alternative that can protect you from the volatility of the traditional grid.

With solar installation costs at historic lows, incentives and financing options more accessible than ever, and power costs skyrocketing, there’s no financial benefit to waiting to switch to solar.

Our team would love to see if solar is a good fit for your home, answer all your solar-related questions, and show you your potential paybacks from investing in a solar system. Book your free consultation today!