As energy costs continue to climb, homeowners are left searching for ways to regain control of their budgets. Investing in a solar system is a smart way to stabilize (and even lower) your monthly expenses.

However, for many homeowners, the thought of going solar can seem daunting. Misconceptions about paying for a system in cash, needing a large down payment, or having to navigate complex or less-than-honest financing options often stop homeowners from exploring solar power as an option.

Whether you pay in cash upfront or choose financing, solar technology ultimately pays for itself through energy savings and government incentives. If paying in cash isn’t an option, partnering with a trusted financing provider can help make the switch to solar more affordable.

However, not all loans and lenders are created equal.

At Exact Solar, we want our customers to get the best quality solar systems at a fair price. That’s exactly why we’ve partnered with Clean Energy Credit Union.

Out of all the financing options we’ve encountered in our twenty years in business, CECU stands out by leaps and bounds for their fair lending practices, mission-driven approach, and exclusive focus on clean energy projects.

In this guide, we’ll give you an overview of solar loans, explain why we chose Clean Energy Credit Union as a financing partner, and help you get started on financing your solar system.

Table of Contents

What is Solar Financing?

Home solar systems are a smart investment that can pay for themselves over time. Through energy savings, tax credits, solar renewable energy credits (SRECs), net metering, and even increased home values, homeowners can reap the benefits for decades.

While solar systems are a major purchase, typically costing tens of thousands of dollars, they are built to last. In Pennsylvania and New Jersey, these systems usually pay for themselves within 6 to 8 years, providing homeowners with decades of free energy.

We understand that not everyone has the cash to cover the entire upfront cost of their solar project. If that’s the case, homeowners can work with their installer to find a third-party financier to borrow the money to cover the installation costs.

How Does Solar Financing Work?

Financing a solar system is like financing a car, house, or anything else that often requires a loan to cover the upfront cost. With a solar loan, a lender provides funds to cover the installation cost, allowing the homeowner to pay the lender back over time with interest.

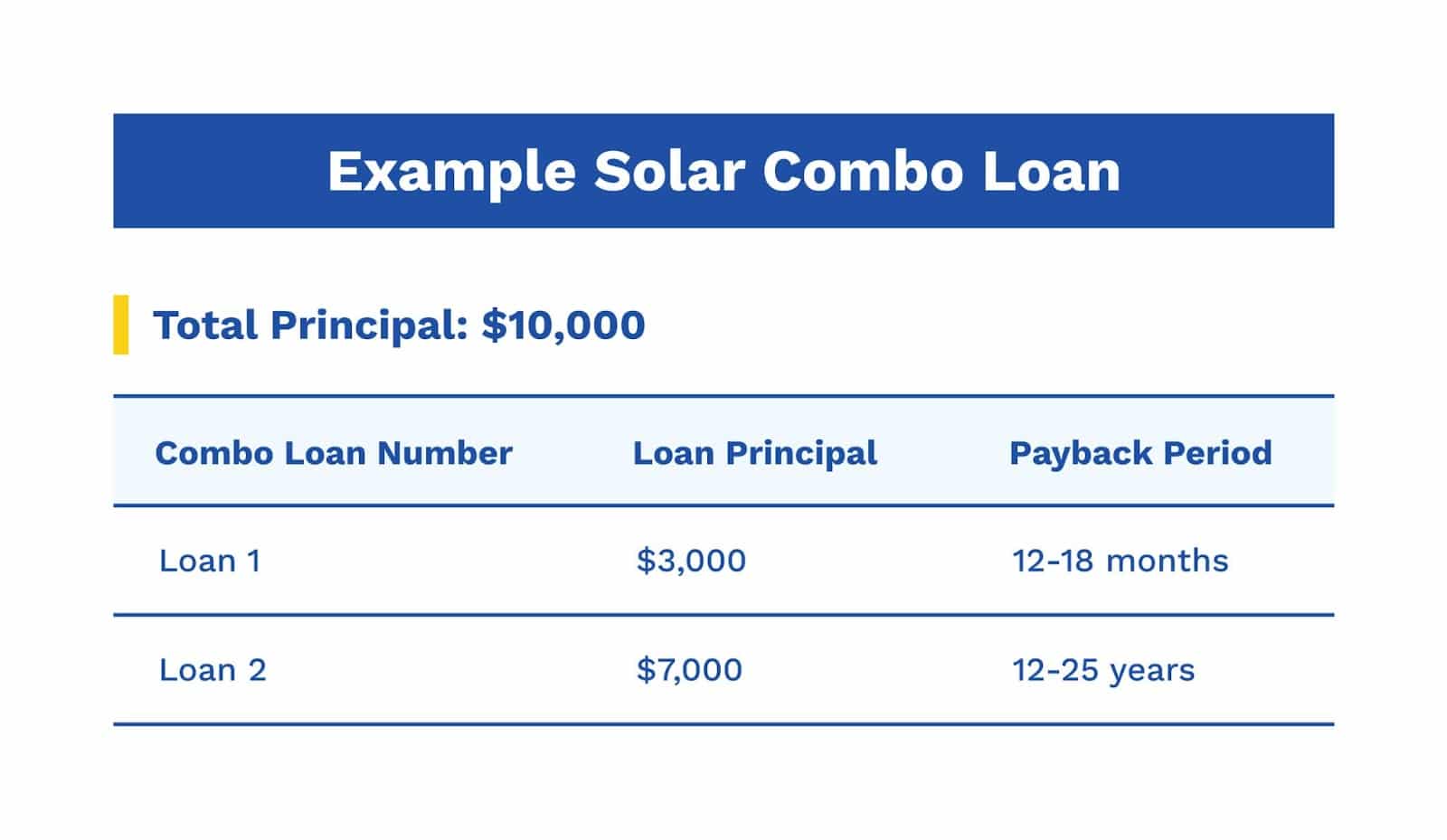

Often, solar loans are bundled as combo loans. In this model, two loans are taken out to cover the system cost, one for 30% of the total cost and one for the remaining balance.

What is a Solar Combo Loan?

Thanks to the Investment Tax Credit (ITC), homeowners who invest in a solar system receive 30% of their project costs back on their taxes for the tax year they receive permission to operate their system.

Given this substantial tax benefit, financing the entire system balance as a single loan may not be advantageous. By splitting the loan into two parts and bundling them, lenders enable homeowners to maximize their tax credit while minimizing their immediate financial obligations. This approach allows homeowners to take advantage of the ITC in the following tax year, making solar more accessible and manageable over time.

“The way we approach our combo loan process is designed to help members avoid paying both a loan and utility bill at the same time. The first short-term loan closes when installation starts, and the second long-term loan closes after the system receives PTO (permission to operate). We don’t want members paying for a loan on a system that isn’t yet operational, so this process ensures that payments only begin once the system is working and offsetting utility costs.”

– Nicole Burford, VP of Marketing Development and Sustainability at Clean Energy Credit Union

The first loan will cover 30% of the project cost with a 12 to 18-month repayment schedule. When the homeowner receives their tax credit, they can use these funds to pay off the balance of this loan. If they cannot pay the balance by the end of the 18-month mark, the remaining balance will be rolled into the second loan.

The second loan will cover the remaining balance after applying the tax credit. This loan will have a longer repayment period of 12 to 25 years.

Here is an example of what a combo loan would look like when financing a $10,000 system:

Why Homeowners Choose Solar Loans

Many homeowners choose to finance solar systems to enjoy the benefits without tying up a large amount of cash all at once. Others opt for longer financing periods so their monthly payments are lower than their current utility bills, which often increase over time.

Whether paid for in cash or financed, solar is a smart investment. If you’re a homeowner, you almost certainly use electricity each month. However, when your home is connected to the grid, you likely aren’t offered a choice in your energy supplier. Most people have little say in where their electricity comes from, but must continue paying their monthly utility bills.

By financing a solar system, homeowners are investing in a power-generating asset rather than paying the power company. Investing in solar means having a say in where your energy comes from, using clean energy instead of fossil fuels, and earning money back from government incentives and local utilities.

Just like with any other purchase, it’s important for homeowners to do their due diligence when financing a solar system. Not all loans and lenders are created equal. This is exactly why Exact Solar chose Clean Energy Credit Union as a financing partner.

Clean Energy Credit Union

Clean Energy Credit Union (CECU) is a mission-driven lender dedicated solely to supporting clean energy projects. Unlike traditional for-profit lenders, CECU is a non-profit, which allows them to offer fairer, more competitive rates to homeowners looking to go solar.

Exact Solar partners with CECU due to their commitment to ethical lending and transparent, member-focused policies. Our partnership ensures homeowners can finance reliable, high-quality solar installations with affordable and equitable financing options.

“I like that Clean Energy Credit Union is non-profit, mission-aligned, and offers the best value to our customers. Financing solar can be an intimidating prospect for many homeowners, but CECU eases people’s hesitation because they are so transparent in their model, and great to work with. Their rates are lower than anything else out there, and they have been doing this for many years. We are a very customer-focused company here at Exact Solar, so there are very few lenders that meet our standards and make us feel comfortable offering to our customers, but CECU is the best out there.”

– Doug Edwards, President at Exact Solar

CECU’s Background

CECU was founded in 2017 by industry pros from Namaste Solar to expand access to clean energy by offering affordable financing options. As a non-profit, CECU can reinvest their earnings into improving loan terms and supporting members rather than prioritizing profits.

They invest only in clean energy projects, helping their members finance things like:

CECU operates entirely online, allowing them to eliminate the overhead costs associated with maintaining physical branches. This approach enables them to focus more on their members and offer competitive services.

What Makes CECU Unique

As a member-owned credit union, Clean Energy Credit Union prioritizes members’ financial well-being over profit margins. They’ve built deep niche expertise in their seven years in business by only financing clean energy projects and vehicles. Business Insider lists them as America’s top “eco-friendly” credit union.

CECU employs a thorough vetting process to determine which solar installers they will partner with. They require installers to have at least two years of solar installation experience to demonstrate their expertise. Additionally, they review each installer’s financial health to ensure stability and their ability to honor long-term warranties.

All partners must hold relevant certifications and undergo training to ensure they fully understand CECU’s loan products. Ultimately, this vetting process protects consumers and ensures that they are working with qualified and trustworthy installers who are committed to supporting their solar investment.

Why Choose Clean Energy Credit Union (CECU)?

Mission, Not Profit-Driven

In a traditional lending model, lenders often bury hidden fees within their loan products to artificially lower their interest rates. Here’s how it works: a lender may add these hidden fees to the principal amount of the loan. This allows them to present a lower interest rate to customers, making the loan appear more attractive.

In reality, the customer pays more over time because the overall loan amount has been inflated by those hidden fees. Lenders do this to make their numbers look good, allowing them to bundle these loans together and sell them as an investment to generate profit.

Unlike traditional lenders, CECU’s model benefits homeowners, not investors. Since they’re a nonprofit, no shareholders are expecting high returns. CECU can offer its members more affordable rates and transparent loan terms than a traditional lender.

CECU’s mission is to make clean energy more accessible to everyone. Homeowners can trust that their financing practices are driven by values, not profits. Homeowners who work with CECU know they won’t be hit with the hidden fees or unfavorable terms that are all too common with for-profit lenders.

Supportive of Both Installers and Homeowners

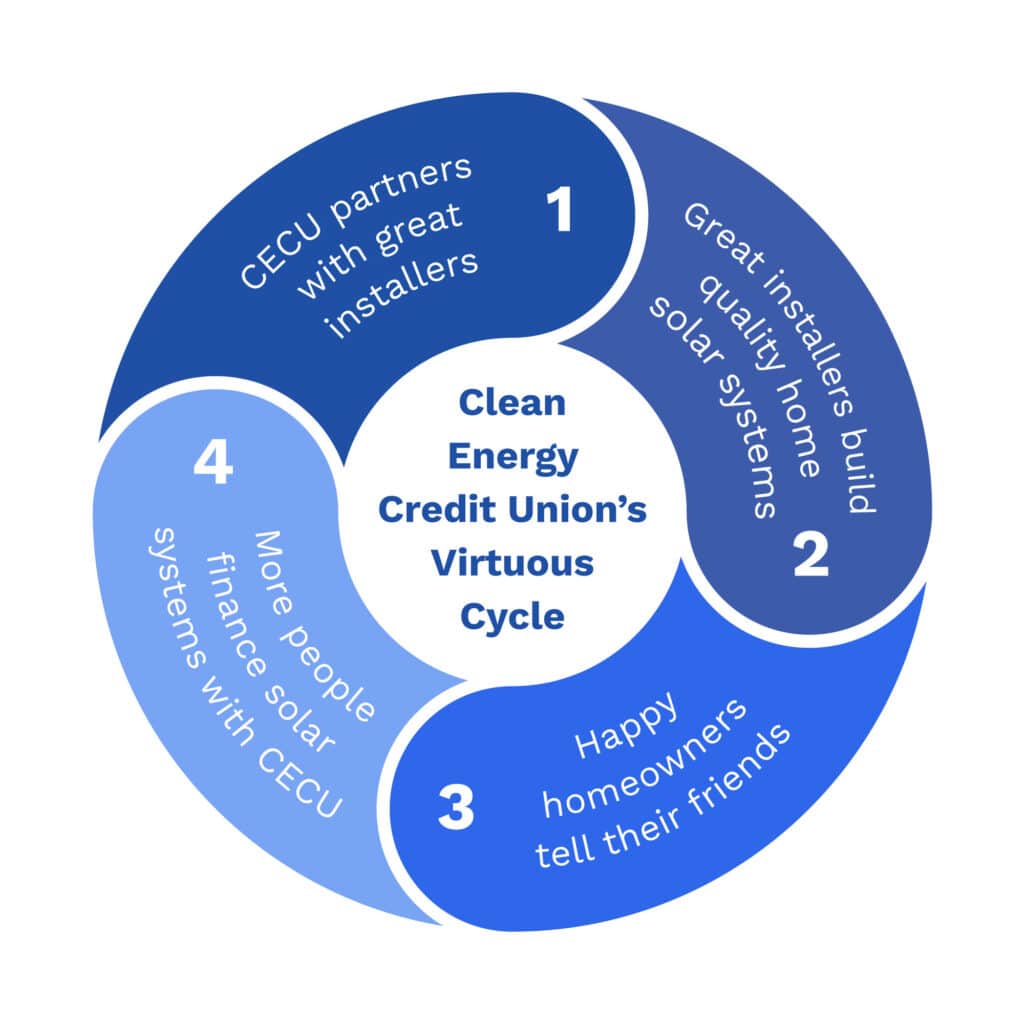

CECU only partners with installers they’ve vetted for quality so they can guarantee high-quality service and support for the life of any solar loan. They work with each installer within their network to ensure they intimately understand their financing products.

By creating a network of vetted installers, CECU helps the highest-quality installers in any given region rise to the top. Due to their stringent selection process, CECU has a long waitlist of installers wanting to work with them.

“We have quite the waitlist for solar. In 2022, we began our registered dealer program as the solar space started to grow rapidly, and we wanted to ensure that we were partnering with certified, experienced installers. We’re a member-focused organization, so it’s critical for us to protect our members by ensuring that the installers we work with have the right certifications and are financially sound. It’s all about providing a good experience for our members and the solar contractors.”

– Nicole Burford, VP of Marketing Development and Sustainability at Clean Energy Credit Union

This is the best model for quality solar installers and homeowners. CECU’s choice to only work with the best installers supports a virtuous cycle of good business practices.

Flexible Refinancing

Clean Energy Credit Union offers refinancing options that make it easy for homeowners to adjust their solar loans over time. Whether interest rates decrease or financial circumstances change, CECU offers flexible refinancing terms that allow homeowners to take advantage of lower rates without costly penalties.

Unlike for-profit lenders, who often impose hefty refinancing fees, CECU uses a low-cost structure with a 1% refinancing fee or a minimum of $250. CECU does not impose any prepayment penalties, so homeowners can repay their loans however they’d like.

How CECU Compares to Other Solar Lenders

The Hidden Costs of For-Profit Lenders

For-profit lenders across industries often lure customers with seemingly attractive low interest rates, but these usually come with significant hidden costs. While at first glance, these lenders appear to offer a better deal, homeowners often find themselves paying much more in the long run due to compounding fees and higher total loan costs. These costs can also include high origination fees or early payment penalties, which erode the value of the low advertised rates.

One of the most common hidden costs is dealer fees, which are sometimes tacked onto the back end of promotional loans without transparency.

As an example of how this looks in practice, let’s say homeowner A wants to finance a $50,000 solar system. They go to Clean Energy Credit Union. CECU offers them a loan with an 8% interest rate on the project’s total cost. Homeowner B goes to a for-profit lender who tells them, “We have a promotional 6% rate.” The buyer is enticed and decides to use the “promotional rate” on their system, thinking they’ll save money. The lender then adds 20% to the total loan principal to “buy down” the interest rate to 6%. So now, instead of financing a $50,000 project at 8%, Homeowner B is now borrowing money to finance the total project costs plus an additional $10,000 dealer fee ($60,000 total) at 6% interest. If these homeowners both get twelve-year loans and don’t pay them off early, then homeowner A will pay $77,936.59 in principal and interest. Homeowner B will pay $84,313.46 for the same product.

Additionally, some lenders engage in questionable practices that have led to legal action—several of the largest lenders in the solar industry have faced lawsuits over deceptive loan practices, including accusations of misrepresenting loan terms or burying important details in the fine print.

CECU’s Transparent Loan Practices

Unlike many for-profit lenders that obscure their fees and terms, Clean Energy Credit Union is committed to complete transparency.

CECU’s members know exactly what they are signing up for. Instead of pushing promotional rates that include buried costs, CECU offers straightforward and competitive interest rates designed to serve their members without misleading tactics.

Because CECU operates as a non-profit, they can offer more favorable terms without needing to pass on costs like for-profit lenders often do.

“Clean Energy Credit Union is a group of seemingly mission-driven individuals providing funding to clean energy projects and making it very straightforward, fair, and basic to enable more people to go solar and invest in clean energy and energy efficiency. They do not move at an urgent pace, they do not gouge customers with deceiving interest rates and then tack on exorbitant “fees” like so many other financing organizations do. Rather, they have a straightforward approach that allows a client to choose between a combination of loan types, with or without upfront cash, and whatever the client chooses, CECU performs their creditworthiness analysis and voila! It’s relatively simple and easy to engage, if you want to deal with a down-to-earth organization and have a bit of patience.”

– David Hammes, Sales Engineer at Exact Solar

CECU’s Commitment to Fair Lending

CECU is deeply committed to fair and ethical lending practices that prioritize the well-being of their members over quick profits.

While traditional lenders often offer rapid approvals (sometimes within minutes), these quick decisions sometimes overlook important financial details that affect the borrower’s ability to manage the loan long-term.

Clean Energy Credit Union approves members for loans through a detailed process that includes income verification, credit checks, and financial reviews to ensure borrowers can responsibly manage their loan payments.

For low-income members, CECU offers additional flexibility through their Clean Energy for All program, which provides discounted interest rates and credit consideration for those facing financial challenges. This includes offering rates matching borrowers with a 680 credit score, even if their actual score is lower.

While CECU’s approval process may take longer than some people are used to, it ensures that homeowners are not placed in a position where they may default or struggle with payments.

Their commitment to responsible lending includes offering loans without prepayment penalties and providing flexible options for refinancing.

Why There Aren’t More Lenders Like CECU

By now, readers might be wondering, “Why aren’t more banks and credit unions doing what CECU does? Why aren’t more banks financing green projects and not using questionable lending tactics?”

Quite simply, the financial world is very slow to embrace anything new. Many banks shy away from these offerings because the risks of green lending and creating combo loans aren’t yet widely understood. Luckily, Clean Energy Credit Union is working to educate the financial world.

“The green lending space is still very new to most financial institutions, and we’re working hard to change that. We do a lot of work to train other credit unions by creating courses, hosting webinars, and joining conferences to show them the benefits of green lending. Solar is still unfamiliar territory for many, and the risk isn’t fully understood. But we’ve been fortunate to experience minimal defaults, which allows us to lead by example and demonstrate the value of green lending.”

– Nicole Burford, VP of Marketing Development and Sustainability at Clean Energy Credit Union

Why CECU Partnered with Exact Solar

Exact Solar and Clean Energy Credit Union chose to partner because of a shared commitment to delivering high-quality, sustainable solar solutions.

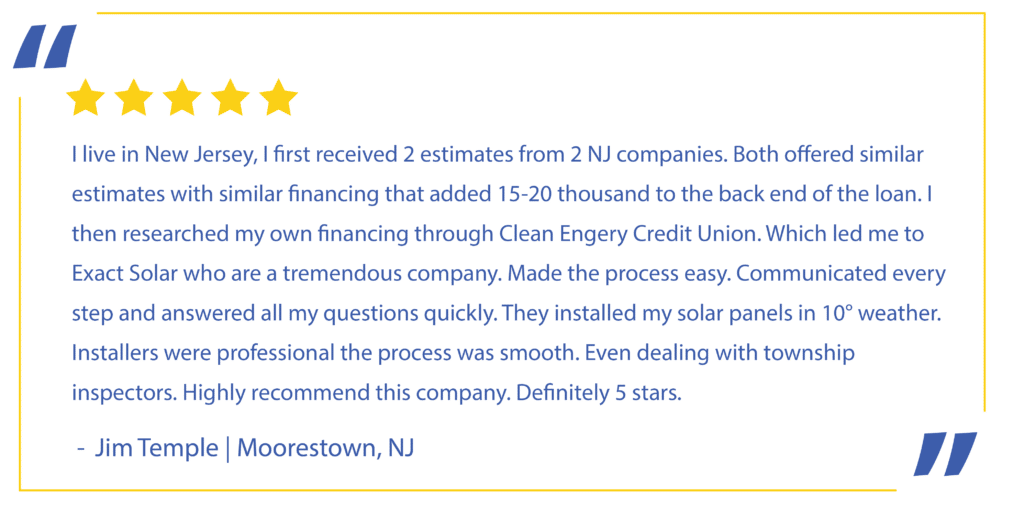

CECU only works with vetted installers, and a reputation for delivering excellent customer service and reliable installations made Exact Solar an ideal candidate. By collaborating with Exact Solar, CECU can trust that any of their Pennsylvania, New Jersey, or Delaware members are in the hands of a highly experienced, ethical, and customer-focused solar installer.

Exact Solar has two decades of experience building high-quality installations across Pennsylvania, New Jersey, and Delaware. Our dedication to using industry-leading equipment and maintaining the highest installation standards ensures that customers receive solar systems that perform efficiently and last for decades.

Working with a lender like CECU helps Exact Solar guarantee that our customers have the best possible experience going solar. We share CECU’s mission of making clean energy more accessible and affordable for homeowners. Homeowners who can’t pay upfront in cash deserve to partner with a non-profit, mission-driven lender like CECU.

How to Get Started with CECU Financing

Becoming a Member

Applicants must be members of Clean Energy Credit Union to finance with CECU. Luckily, it’s relatively easy to become a member!

Unlike banks, credit unions only provide services to a “field of membership.” To apply to bank with a credit union, potential members must belong to a certain university, organization, or religion the credit union serves.

Clean Energy Credit Union serves 22 clean energy organizations, including:

The full list of 22 registered partners can be found here.

To be eligible to bank with Clean Energy Credit Union and apply for clean energy loans, homeowners must become a member of any one of these organizations.

We recommend that any homeowners interested in working with Clean Energy Credit Union sign up for a year of membership in the American Solar Energy Society.

Loan Requirements

To qualify for a solar system loan with Clean Energy Credit Union (CECU), applicants must meet certain criteria, including stable income, homeownership, and good credit.

Applicants should prepare documents that show proof of income, credit history, and information about their home’s solar project (this should be supplied by the installer). CECU then carefully analyzes creditworthiness to ensure the loan is a responsible match for the borrower’s financial situation.

Applying for a Solar Loan with CECU

If you decide to become a CECU member and finance a solar project, here are the steps you’ll take to secure financing:

- Referral to a Certified Installer

CECU works exclusively with vetted, experienced installers. If you’re a member of CECU and you tell them you’d like a loan for a solar system, they’ll refer you to one of their trusted partners in your area. - Project Evaluation

Once you’ve scoped out a project with a certified installer, CECU will request details, including quotes and site plans. - Loan Application on CECU’s Website

After choosing your installer, you can apply for a loan on CECU’s website. This requires filling out an application form with your financial details, such as income, assets, and credit history. - Credit Analysis and Documentation

CECU will perform a detailed credit analysis as part of the application review. They may ask for additional documentation to complete the assessment, such as proof of income or credit history. It’s important to have these documents ready to avoid delays. - Loan Terms and Approval

After reviewing your application and financials, CECU will determine your loan terms. You’ll receive a detailed breakdown of the loan structure. - Loan Finalization and Installation

Upon approval, CECU will finalize the loan, and the funds will be dispersed to the installer once the installation begins.

Navigating the Approval Process

Once a loan application is submitted, CECU performs a thorough review to determine loan eligibility. They consider key factors such as credit score, income stability, and the quality of the solar project.

The approval process may take slightly longer than most for-profit lenders, depending on the complexity of the project and the applicant’s financial situation.

Make the Smart Choice with CECU and Exact Solar

Clean Energy Credit Union is the best financing partner for homeowners investing in solar energy. When their favorable financing is combined with Exact Solar’s two decades of experience, homeowners are guaranteed high-quality solar solutions and fair, affordable financing.

Our team has decades of combined experience finding the best financing options for customers. We’d love to meet with you for a free consultation and determine whether solar is a good fit for your budget and lifestyle!