When the Inflation Reduction Act (IRA) was passed in 2022, it introduced the Domestic Content Bonus Credit to incentivize American businesses to use domestically produced materials in their solar and clean energy projects. The goal is to strengthen U.S. leadership in clean energy manufacturing and motivate businesses across the country to transition to solar.

In the early years following the IRA’s passage, businesses faced confusion over the exact requirements and process for claiming the credit. Fortunately, recent updates from the Treasury Department and the IRS have provided this much-needed clarity.

These changes include a new “safe harbor” option, designed to simplify compliance for projects of all sizes, from small rooftop systems to large utility-scale installations. The updates also specify the required percentage of American-made materials like steel, iron, and components, and outline how to calculate these shares without requiring line-item lists from every manufacturer.

The “safe harbor” approach can streamline compliance for projects using specific standard equipment or meeting guidelines set by the Department of Energy (DOE).

At Exact Solar, we are committed to providing the most up-to-date information on IRA incentives for commercial entities going solar. We closely monitor official publications from the Treasury Department and IRS, and we collaborate with manufacturers to stay informed on new developments in U.S. manufacturing processes.

It’s important to remember that these incentives are still evolving and under negotiation between government agencies and manufacturers. The information provided here reflects our current understanding and should not be considered legal or tax advice.

Important Note: Please consult a financial professional when you’re ready to file for this credit. As these rules may continue to evolve with new guidance, collaborating with a certified accountant, lawyer, or tax professional will ensure you maximize your credit and avoid any potential issues during an IRS review.

Table of Contents

What is the Domestic Content Bonus Credit?

The Domestic Content Bonus Credit is a powerful incentive for businesses to support U.S. manufacturing while investing in solar projects. It provides a 10% bonus tax credit on top of the existing 30% Investment Tax Credit (ITC) for projects that meet specific criteria for using U.S.-made materials.

To qualify for this bonus, project owners must use 100% U.S.-made steel and iron, as well as an increasing percentage of U.S.-manufactured components in their solar projects. This includes essential parts like photovoltaic cells, inverters, and racking systems.

In the IRS’s own words:

“The domestic content bonus credit is available to taxpayers that certify their qualified facility, energy project or energy storage technology was built with certain percentages of steel, iron or manufactured products that were mined, produced or manufactured in the United States.”

How Does it Work?

In simpler terms, the Domestic Content Bonus Credit applies to solar projects that use materials sourced from the United States. The IRS defines this as materials like steel, iron, and other components that are mined, produced, or manufactured in the U.S.

The credit is based on the percentage of these materials used in the project, meaning each element of the solar system, from the racking and supports to the panels themselves, must meet specific thresholds of U.S. production.

Why is it Important?

For businesses planning large solar projects, this 10% bonus credit can significantly improve the financial return on investment. By meeting the domestic content requirements, project developers can increase their total tax credits, making the project more financially viable.

IRS Guidance on the Domestic Content Bonus Credit

In May 2024, the IRS issued new guidance (Notice 2024-41) aiming to simplify the process for claiming the Domestic Content Bonus Credit.

This guidance introduces an elective “safe harbor” option, which allows solar developers to use default cost percentages provided by the Department of Energy (DOE) instead of collecting detailed cost and percentage data from manufacturers.

The elective safe harbor applies to a range of solar and clean energy projects, including ground-mount and rooftop photovoltaic systems.

New Guidance on Solar Tax Credits

On January 16, 2025, the Treasury Department released new guidance with more detailed rules about how to calculate costs for solar projects. The update separates “Solar PV” into two categories: ground-mount and rooftop systems. It also introduces a new column for crystalline silicon modules made with U.S.-sourced wafers. This change helps businesses better classify the different parts of their solar systems and calculate the correct cost percentages based on whether those parts are entirely made in the U.S.

Additionally, the guidance includes new terminology to make things more transparent. For example, instead of the term “rebar,” the new rules now refer to it as “steel or iron reinforcing products in foundation.” These updates are designed to simplify how developers report U.S. content and calculate the bonus credit they may be eligible for.

The IRS’s list of applicable tax credits for clean energy projects can be found here.

Calculating the Domestic Content Percentage for Solar Projects

To claim the Domestic Content Bonus Credit without penalties, developers must meet specific IRS requirements.

These rules categorize solar project components by steel/iron and manufactured products. Developers must prove that all steel or iron used is sourced 100% domestically, and meet certain thresholds for domestically manufactured products.

Steel and Iron Requirements for Solar Projects

All steel and iron used in the construction of the solar facility must be 100% sourced and produced in the United States. This includes the entire mining and manufacturing process, from initial melting through the application of coatings.

Manufactured Products Requirements for Solar Projects

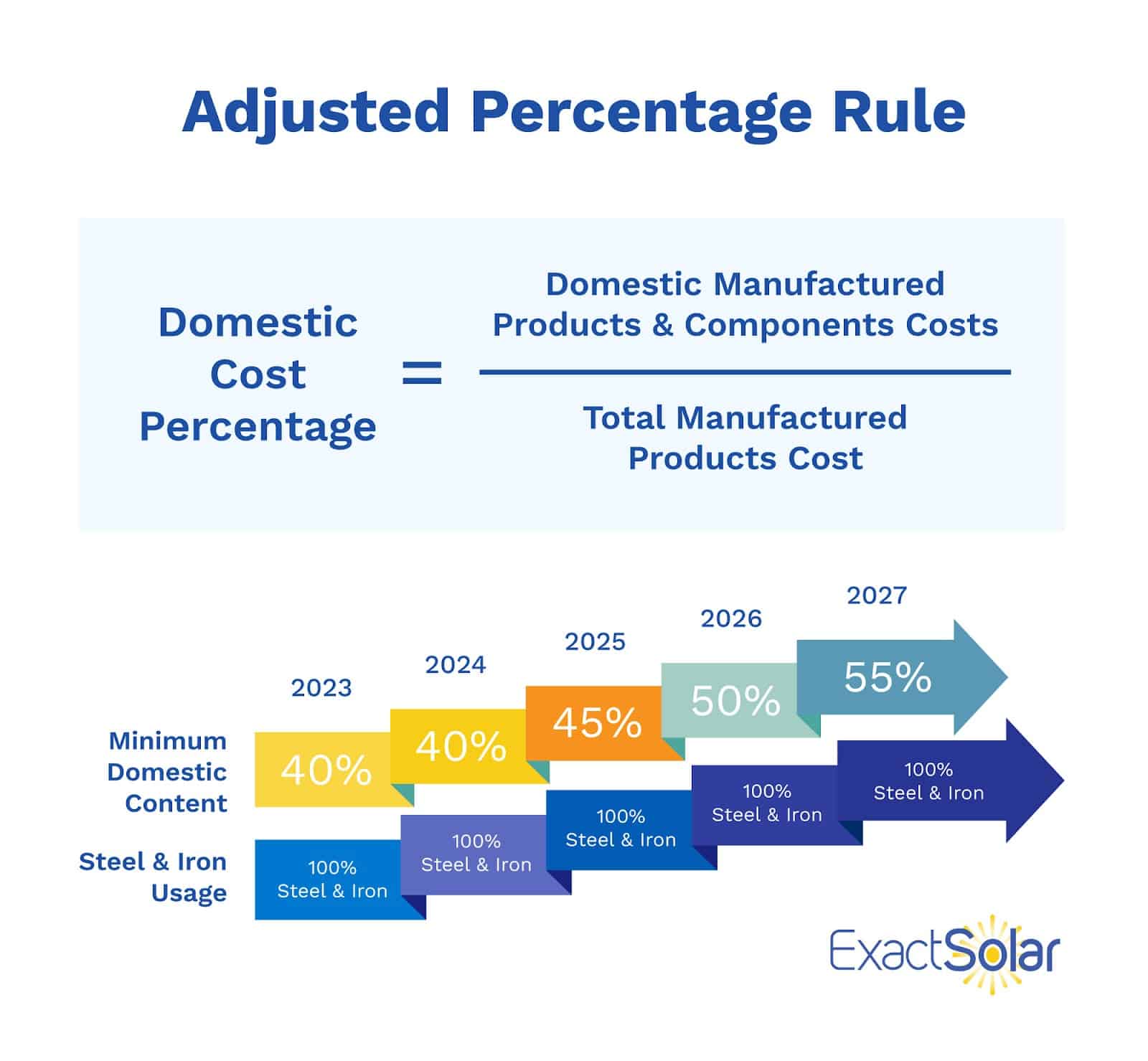

A specific percentage of the total cost of all manufactured products, components, and labor must be attributable to U.S.-produced items. For solar projects, the required percentages are based on the year construction begins. The required percentages increase each year as follows:

- Before January 1, 2025: 40%

- In 2025: 45%

- In 2026: 50%

- After December 31, 2026: 55%

Elective Safe Harbor

In May 2024, the IRS introduced Notice 2024-41, offering an elective safe harbor to help solar and wind project owners qualify for domestic content bonus credits under sections 45, 45Y, 48, and 48E of the Internal Revenue Code. This new safe harbor simplifies the process of meeting domestic content requirements by providing standardized values that developers can use, removing the need to track the origin of every single part of a project.

By opting into safe harbor, developers can use cost allocations based on analyses from the Department of Energy (DOE) or IRS assumptions. This eliminates the time-consuming process of gathering invoices or requesting detailed cost breakdowns from manufacturers. Instead of verifying individual components like fasteners, frames, or specialized electronics, developers can apply the safe harbor’s pre-set percentages and focus only on verifying only the major elements of the project. An additional benefit of this option is more predictable tax planning. Taxpayers can rely on uniform, government-issued figures instead of wrestling with variable supplier cost structures.

Notably, the safe harbor is an option, not a mandate. If developers prefer to gather real cost data to optimize their domestic content calculations, they can still do so. However, for those working with a variety of components, the elective safe harbor offers an efficient, lower-risk path to substantiate domestic content claims and secure associated bonus credits.

Solar Safe Harbor Values

As part of the updated Treasury guidance released on January 16, 2025, which modifies Notice 2024-41, the IRS provides assigned cost percentages to reflect typical manufacturing costs for solar system components, simplifying the process for developers to claim the Domestic Content Bonus Credit. For example:

Ground-Mount PV (Tracking)

- For standard domestic crystalline silicon (c-Si) cells, 38.0% of the total manufactured product cost is assigned to “cells.”

- If both the c-Si cells and wafers are manufactured domestically, the cost percentage for “cells” increases to 51.6%, reflecting the higher value of using U.S.-sourced wafers.

Rooftop PV (MLPE)

- For standard c-Si cells, 31.1% of the total cost is assigned to “cells,” or 43.9% if both the cells and wafers are domestic.

- “Rails” account for 15.0% of total costs in the standard scenario, but this drops to 12.2% if domestic wafers are used, as more of the cost shifts to the “cells” category.

These default values allow developers to apply a single “Domestic Cost Percentage” to each major system or subcomponent. As long as the system aligns with the safe harbor definitions (for example, it’s a ground-mount tracker or a rooftop MLPE system, as described in the notice), developers can rely on these published values instead of collecting detailed cost data from each supplier or manufacturer.

Taxpayers must affirmatively elect to use the new elective safe harbor for their solar projects. An election is made by providing a statement on the domestic content certification statement attached to the relevant tax forms (e.g., Form 3468 for the Investment Credit).

The safe harbor applies to projects using components and manufactured products listed in Table 1 of Notice 2024-41, which will be detailed in the next section.

Using the Elective Safe Harbor for the Domestic Content Bonus Credit

The instructions below specify how to calculate cost percentages using Table 1 in Notice 2024-41. If you are using this article as a guide, be sure to open the linked document before proceeding.

Identify Applicable Project Components

Refer to Table 1 in Notice 2024-41, which lists components for various solar projects, such as:

- Ground-Mount (Tracking)

- Ground-Mount (Fixed)

- Rooftop (Module-Level Power Electronics)

- Rooftop (String Inverter)

Other components include PV modules, inverters, racking systems, and steel or iron products (like rebar in foundations).

Use Assigned Cost Percentages

Each component and its subcomponents have an assigned cost percentage in Table 1. These percentages represent the portion of the total project cost attributed to each component.

Calculate the Domestic Cost Percentage

To calculate the domestic cost percentage, add up the assigned cost percentages of the components that are domestically manufactured within the United States. Any components that are not used or are not manufactured in the U.S. get a zero value.

Determine Compliance with Adjusted Percentage Rule

The project must meet or exceed the adjusted percentage specified for the year in which construction begins. As a reminder, these percentages are:

- Before January 1, 2025: 40%

- In 2025: 45%

- In 2026: 50%

- After December 31, 2026: 55%

If the domestic cost percentage meets or exceeds the adjusted percentage, the project satisfies the domestic content requirements. For example, if a ground-mounted tracking solar project breaks ground in 2024, the adjusted percentage is 40%.

If the sum of the assigned cost percentages of domestically produced components is 47.6%, the project satisfies the 40% requirement and is eligible for the domestic content bonus adder.

Keep in mind that each year’s threshold increase may impact your timeline for beginning construction. Suppose your domestic content calculations are around 39%. In that case, you may accelerate certain procurement decisions or begin construction ahead of schedule to lock in a lower percentage requirement (and thereby ensure you can claim the credit).

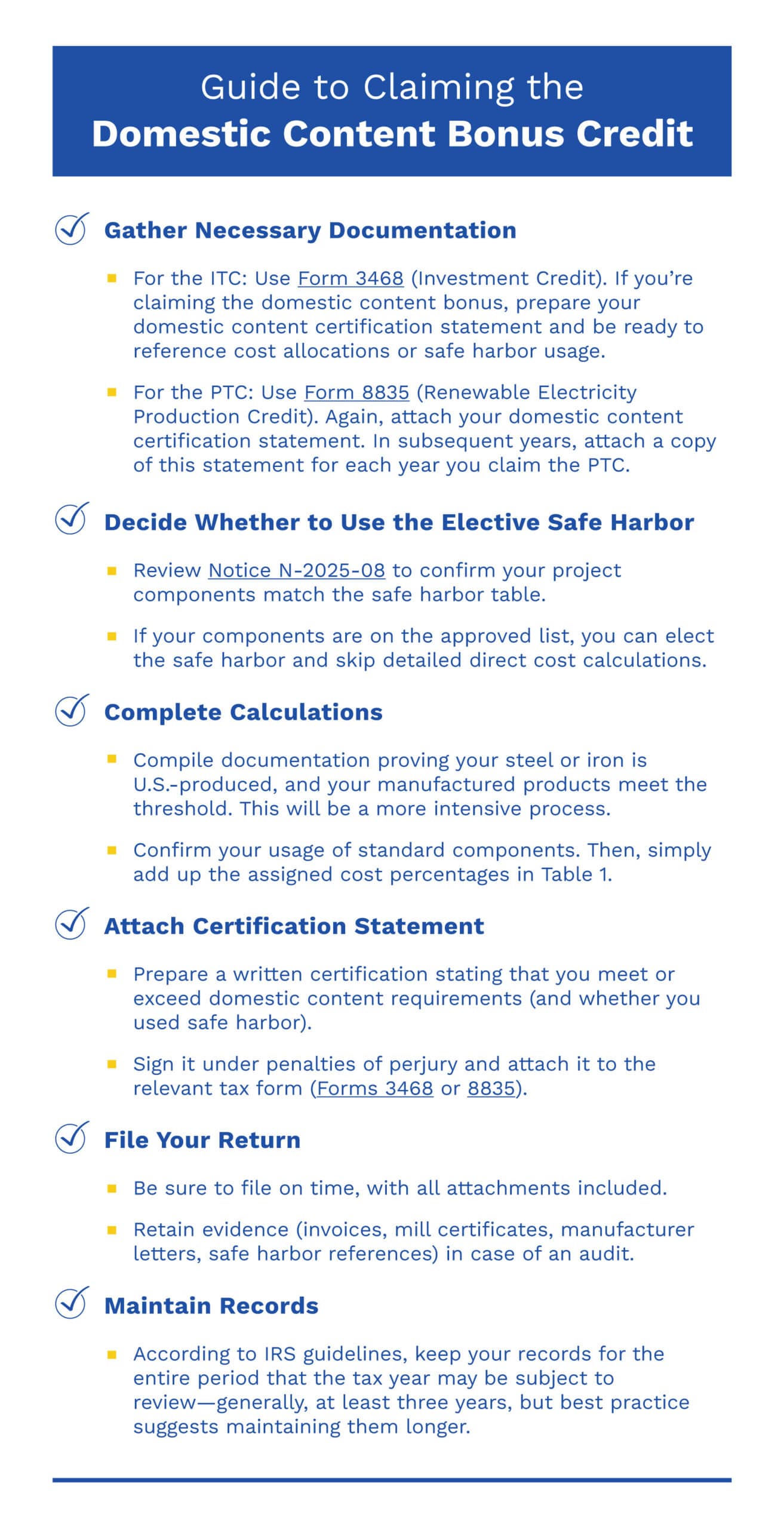

Claiming the Domestic Content Bonus Credit

To claim the Domestic Content Bonus Credit, solar developers must carefully follow IRS guidelines and attach a domestic content certification statement to their tax filings. The IRS specifies:

“A domestic content certification statement must be attached to Form 8835, Renewable Electricity Production Credit or Form 3468, Investment Credit and filed with the taxpayer’s annual return submitted to the IRS for the first taxable year in which the taxpayer reports a domestic content bonus credit amount. For the production tax credit claimed on Form 8835, a copy of the certification statement that was initially submitted must be attached for each taxable year in the credit period in which the credit is claimed.”

This statement must confirm that the project meets the domestic content requirements and, if applicable, relies on the elective safe harbor for its calculations.

Next Steps

With the IRS’s new guidance and safe harbor provisions, the process for claiming the domestic content bonus credit bonus credit has become much more straightforward.

If you’re a business owner interested in owning your power, this bonus credit may just give you the extra financial boost you need to invest in solar energy profitably.

Whether you’re making the decision to go solar purely for cost savings or seeking to display environmental leadership to your customers and team, the Domestic Content Credit can benefit your business. Ready to explore your options? Contact us for a free consultation to determine if solar is right for your business. You’ll come away with a clear picture of potential return on investment, the likely domestic content thresholds you can meet, and how you can best position your company for a cost-effective energy future.