The Inflation Reduction Act, signed into law in 2022, has created a powerful new incentive for homeowners considering a residential solar system.

Among the many provisions of the IRA, lawmakers extended the ITC (Investment Tax Credit) to 30% on solar systems, up from 26% in previous years. Homeowners who install solar systems can now claim 30% of the total cost of their system (including inspection and contracting) against their total tax liability.

There has never been a better time for American homeowners to invest in this powerful energy-producing asset and break free from their utility payments. This incentive remains one of the most compelling reasons to go solar in 2025, especially since the incoming administration will likely target it.

Table of Contents

What is the ITC?

The Investment Tax Credit is a federal tax credit designed to encourage homeowners to adopt renewable energy sources, including solar power.

The ITC was created in 2005 and came into effect in 2006 to boost the renewable energy industry. Since the inception of the Investment Tax Credit and other government incentives, renewable energy has grown 10,000% year-over-year, an average of 50% per year in the last ten years.

It was set to expire in 2023, but The Inflation Reduction Act extended the ITC and raised it to 30%, excellent news for those considering solar installations. It allows homeowners who invest in residential solar energy systems to receive a tax credit based on a percentage of their system’s total cost.

What is the Inflation Reduction Act?

If you’re not familiar with The Inflation Reduction Act, it was signed into law in 2022 to address rising inflation and its potential impacts on the U.S. economy. It includes various measures to reduce inflation, stimulate economic growth, and support American families.

For homeowners interested in residential solar in 2025, the most important provision within the IRA is the extension of the solar Investment Tax Credit until 2034 and its increase to 30%.

This credit significantly benefits homeowners interested in solar energy by offering them a 30% tax credit on the total cost of any new solar system.

How the Inflation Reduction Act Impacts the ITC

- Increased ITC Percentage: The Inflation Reduction Act raises the ITC rate from 26% to 30% for projects started in 2022, providing homeowners with an even more substantial financial incentive to invest in solar energy systems.

- Extended Timeline: Before the IRA, the ITC was set to phase out for residential projects in 2023. However, the new legislation extends the ITC for residential solar until 2030. This longer timeline offers homeowners more flexibility and time to plan for their solar projects.

- No Maximum Credit Cap: The Inflation Reduction Act removes the maximum credit cap for residential solar installations. Previously, homeowners were limited to a set amount, but now they can claim a 30% credit on their total solar system cost, regardless of the project’s size or price.

Who is Eligible for The ITC?

Your solar PV system must meet these conditions to qualify for the tax credit:

- The system must be installed in the United States between January 1, 2017, and December 31, 2034.

- The solar PV system must be installed on your primary or secondary residence in the United States (secondary residences aren’t eligible for the full credit).

- You own the solar PV system (meaning you bought it with cash or through financing, but you are not leasing it or paying a solar company for the generated electricity).

- The solar PV system is either built of entirely new materials or materials being used for the first time. The credit is only for the initial installation and first use of the solar equipment.

Benefits for American Homeowners

For American homeowners interested in residential solar, the extended ITC offers several benefits:

The 30% Federal Investment Tax Credit reduces the overall solar system installation cost, providing homeowners with significant financial savings. This tax credit can make solar energy more affordable for a broader range of homeowners.

With a higher tax credit, homeowners can expect a shorter payback period for their solar investments. The savings from the ITC can offset installation costs, helping homeowners see faster returns on their energy-producing assets.

Since residential solar installations can reduce or even eliminate monthly energy bills, the ITC’s extension incentivizes homeowners to switch to clean and renewable solar energy.

How to Claim Your ITC

Important Note: Eligibility for this credit varies from person to person based on their financial situation, so we strongly encourage you to consult with your tax professional before attempting to claim it.

To get the tax credit after installing their system, homeowners can use IRS Form 5695 when filing taxes. Here are the IRS’s official instructions for filing the form:

Instructions for Form 5695 (2023) | Internal Revenue Service

After you submit this form, the credit will be applied in the tax filing season following the year your system was installed and finished. If your solar project is completed in May 2023, you’ll receive your tax credit around April 2024.

Now is the Time to Act

The Inflation Reduction Act’s extension and enhancement of the Investment Tax Credit (ITC) are pivotal for American homeowners considering residential solar installations. These changes provide:

- An exceptional financial incentive:

Claiming back 30% of your total system cost on your taxes means more money in your pocket. If you buy your system outright, your solar system will pay for itself 30% faster. If you finance your system, you’ll still claim 30% of the total system cost as a tax credit in your next tax year. Either way, the 30% credit offers you significant savings on your system. - A more extended timeframe:

The ITC was set to expire in 2023, but the Inflation Reduction Act extended it until 2032. Homeowners interested in going solar have a much longer time horizon to claim an even higher incentive.

Be sure to consult with a qualified solar installation provider and a tax professional to maximize the benefits of the ITC and make an informed decision regarding your residential solar project.

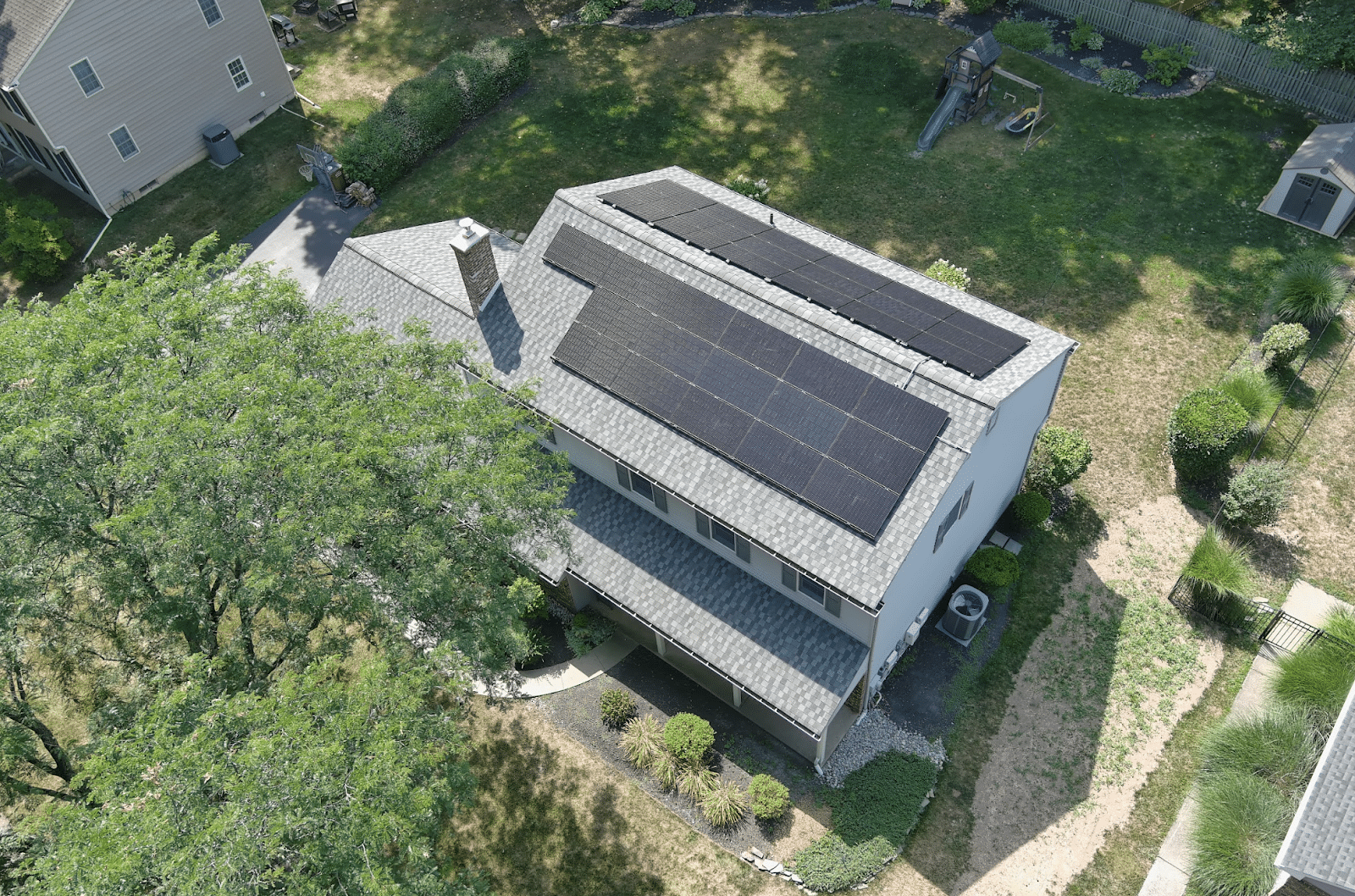

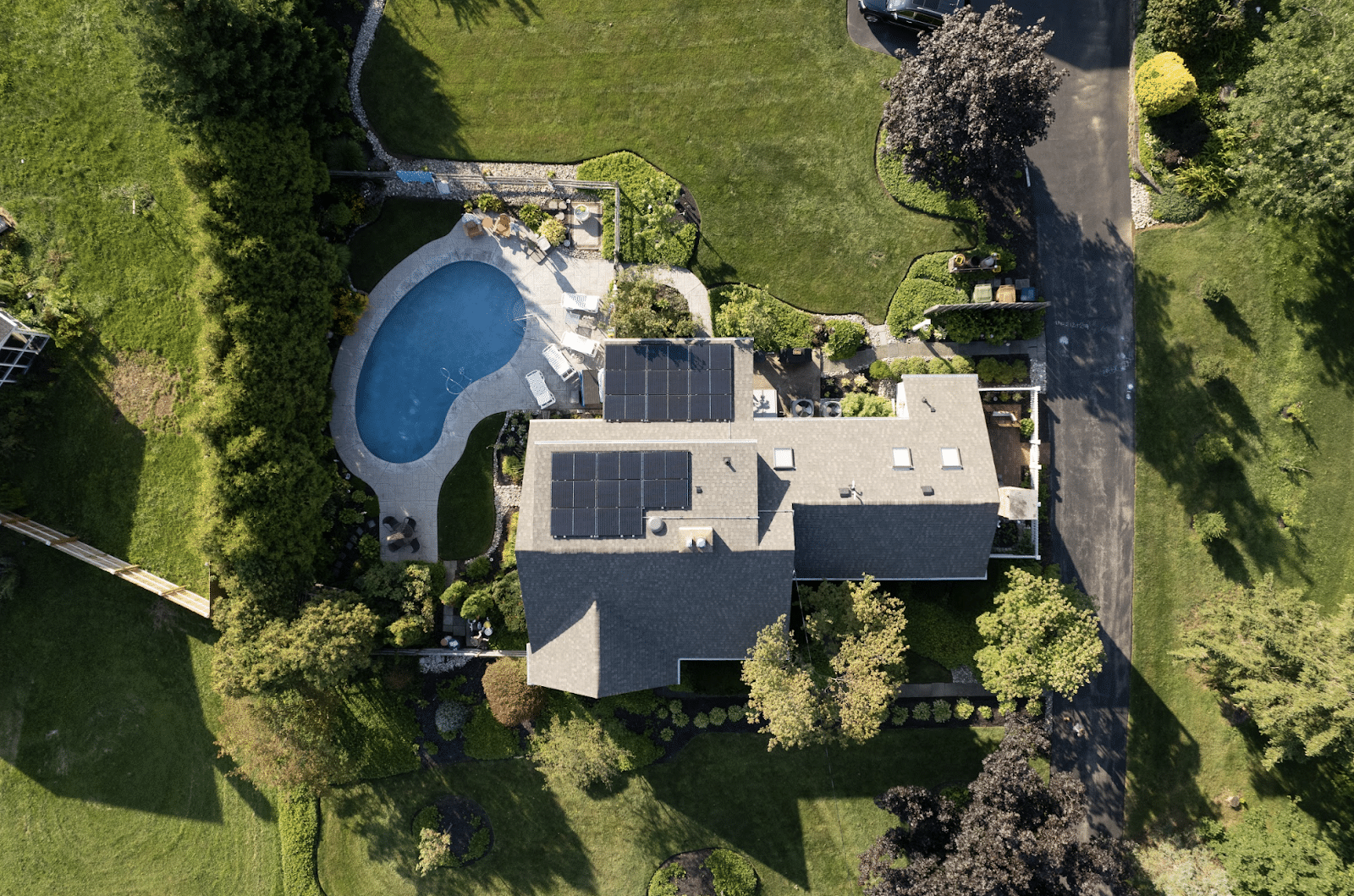

Are you ready to explore the possibilities of a home solar system for your Pennsylvania home? Contact Exact Solar today and schedule your free consultation with one of our expert solar sales engineers.

Exact Solar has a 19-year track record and more than 400 five-star reviews. When you’re researching a solar system, you need good information, an honest evaluation of feasibility and economics for your unique home, and a helping hand to guide you on your solar journey. As your local solar experts, we’re here to provide that and more.